Wealth accumulation needs to be at the forefront of your mind. When you are working, and playing. When you are teaching your children and advising your friends.

Everyone needs to be tired of living paycheck to paycheck. That tight knot in the pit of your stomach when you think about the “what if” is enough to make you want to change. “What if” you lose your job? Or how about getting sick? What do you do if a natural disaster happens or your car gets totaled? Often, we have safeguards in place for some emergencies, but in general, we live in a hopeful delusion. We hope that nothing bad happens, knowing it would be catastrophic if it did.

Instead of banking on nothing bad happening, we need to be planning for the worst, while hoping for the best.

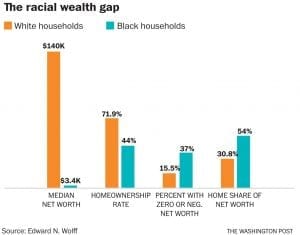

Black Wealth Accumulation

As a collective bargaining unit, black people in America control over 1.5 trillion dollars in spending power. Black purchasing power in America is the result of resiliency and hard work. Although, there is such a high spending power, the wealth of black Americans is depressingly small.

Yes, there are groups of individual wealthy black entrepreneurs that give us hope. But for the most part, the state of accumulated wealth for black Americans is dismal.

Learning how to build black wealth is key!

How is wealth accumulated?

To understand how wealth is acumulated, one must first understand the plethora of events that unfold to work against you.

Tax Laws and Loopholes

The lack of tax information and the current status of tax law for hard working Americans is an increasingly negative factor. Tax laws are skewed towards the rich, since there are a multitude of laws and loopholes that only benefit the 1%. And even the laws that may benefit you or I, are shrouded. So much so, only someone who can afford a tax attorney or accountant, would be made aware of them.

So, the rich know which laws and loopholes to exploit to maintain and grow their wealth. But what does everyone else know? Not much. The going assumption is that you have to be poor to get money back and you have to pay once you make any real money. We look at people like Donald Trump and corporations like Wal Mart and assume they are involved in illegal tax fraud because they don’t pay the taxes they should. But the truth is, their lawyers and accountants know exactly what to do.

Inflation

You may not understand inflation or how it affects you, but trust me, it does. The idea of inflation, put in its simplest terms is this: What may have cost you only $1.00 to buy years ago, now costs $1.25. You may argue that an extra quarter or a few pennies is inconsequential. But ramp that up in a larger scale. Think about what might have only cost you $100,000 or $200,000 a few years ago would cost you $125,000 or $250,000 now.

Inflation in itself wouldn’t be so bad if the widely prescribed method of go to school and get a job was a comparable model to follow. It is not!

Real Wages are Falling Flat

More people have jobs and work more hours, but actual wages aren’t increasing that much. When compared to inflation, we are still losing money. According to this article on Brookings website, real wage growth is closer to zero because higher inflation isn’t being offset by incomes. So while you may get a raise or higher salary, the cost of living/inflation increase keeps the value of your dollar low. You are receiving diminishing returns for every penny spent.

What’s your wealth accumulation plan?

The only true way to beat back the rising tide of poverty or stagnant financial success is with a plan. And in order to have a working plan, you must understand what your goals are.

Whether you decide to work for a company and capitalize on the insurance plans and stock options the employer provides, open a business, freelance, or invest…you must have a plan.

Understanding and implementing the right plan can make the difference between success and repeated failures. And when I say “have a plan”, I don’t just mean a plan of action. I also mean a plan of strategy to create, grow, and preserve your wealth. I wrote an article that goes into depth on what a Legacy Wealth Management Strategy should include, so if you need pointers…check it out.

Following the Principles of Wealth Creation

Making a plan and following a strategy are the keys. But you might still remain stuck if you don’t understand the what and why’s. Unless you understand the 7 Principles of Wealth Creation, you might just be creating assets that will get squandered in taxes, or pilfered upon your passing.

Budgeting for wealth accumulation

What happens to most people on payday? They calculate their bills, past due and upcoming, they major expenses. And then play with whatever is leftover. That is the absolutely worst way to sustain or grow any type of financial success.

Try this. Create a budget. Intricate and detailed. Add all you bills, what you need to pay monthly to erase old debts and avoid long term new ones. Add your household expenses. But here’s the trick. Include your habits, bad or otherwise. Include your smoking or drinking. Your takeout or movie theater expenses, the club entrance fees. You need to have every single thing you spend money on every month in your budget. There is no such thing as left over or extra money. Not one single penny.

Once you have a complete budget in place. Stick to it. And when you get ready to invest in your wealth accumulation, you can look at your budget and be able to take $5 from here and $20 from here. But remember, there should be no leftovers in your budget. Every single penny should be accounted for.

Wealth Preservation

Preserving your wealth isn’t about having an underground vault filled with gold bars. It’s about legal safeguards that protect your wealth from depreciation or from being scavenged after you die. In order to properly preserve your wealth, you need to be well versed in tax laws, have a will in place, and have your money and assets constantly working to increase their value at all times.

Share on facebook

Share on twitter

Share on linkedin

Share on pinterest

Share on reddit

Pingback: How to Build Black Wealth in your 20's and Beyond - Black Generational Wealth