In the years since Emancipation, the state of the African American community has improved. We can now vote, attend institutions of higher learning, and hold public office. However, since the ‘60s, the numbers indicating financial growth and black wealth accumulation have stagnated. Save for a select few, members of the black community have been unable to attain true financial freedom.

In 1966, a hundred years after the Emancipation, African Americans made up more than 10% of the American population. Yet, we still held less than 2% of the country’s wealth, and only 0.1% of this was in stocks. Black landowners in the South held less than a tenth of the wealth owned by white property owners.

Wealth of American families in 1966

Wealth Accumulation Comparison

Black families held about 1.9 percent of American wealth, with US$18.3 billion in assets compared to white families’ $941.9 billion.

TYPE OF ASSET | WHITE | BLACK | BLACK SHARE OF TOTAL |

Business equity | $104.6 b | $1.3 b | 1.2% |

Equity in home | $358.1 b | $12.8 b | 3.5% |

Farm equity | $152.3 b | $1.9 b | 1.2% |

Government bonds | $25.5 b | $0.3 b | 1.2% |

Money in bank | $157.8 b | $1.8 b | 1.1% |

Value of stocks | $143.6 b | $0.2 b | 0.1% |

Chart: The Conversation, CC-BY-ND Source: The Review of Black Political Economy (1974) Get the data

Lack of security for black-owned wealth and an absence of succession plans were great hindrances to building and sustaining black wealth over the years. All these factors, coupled with the hostile political environment, predatory loans, high-interest rates on student loans, red-lining, etc., sent the black community limping into the 20th and 21st centuries.

Sadly, the wealth gap between the races increases, even in the instances where African Americans have a college education. Studies have shown that a white family with a high school dropout as the head is more likely to be wealthier than a black family with a graduate. White people have and retain more family wealth.

In a 2017 report written by the Federal Reserve System, data provided by the Survey of Consumer Finances (SCF) shows that the average black household has just 10 cents to every dollar held by the average white household.

Mean and median net worth by race and educational attainment of head, 2013-16 surveys

A 2013-2016 study shows that white Americans have more wealth than black Americans and other races, regardless of education level.

Thousands of 2016 dollars

| Median net worth | Mean net worth | ||

2013 | 2016 | 2013 | 2016 | |

No bachelor’s degree | ||||

White | 87.1 | 98.1 | 323.1 | 367.8 |

Black | 10.3 | 11.6 | 78.9 | 99.3 |

Hispanic | 13.1 | 17.5 | 76.3 | 105.7 |

Other | 17.4 | 34.3 | 128.8 | 183.7 |

Bachelor’s degree or higher | ||||

White | 375.5 | 397.1 | 1,440.1 | 1,821.3 |

Black | 36.8 | 68.2 | 184.4 | 271.2 |

Hispanic | 58.0 | 77.9 | 401.8 | 609.6 |

Other | 216.1 | 210.2 | 813.0 | 941.0 |

Source: Federal Reserve Board, Survey of Consumer Finances.

Wealth and Poverty in the black family

Wealth is considered the measure of success and being wealthy is celebrated across the racial divide. However, the functional value to having wealth is in enjoying the freedom, and economic security wealth provides.

The fair and just way for the United States Government to address these grievances is by enacting a comprehensive reparation program. This program should acknowledge the years of unfair treatment, and offer compensatory restitution, which includes money, land, and other means of production. While our leaders rightfully cry out against institutionalized economic injustice, we must individually and collectively utilize our creativity, resources, knowledge, hard work, faith, hope, and perseverance. Let us march out of the chains of poverty, victoriously.

For us, black people, we should consider resilience the most potent weapon in our quest to build up our wealth.

As the author Dr. Dennis Kimbro states in his books, “The Wealth Choice: Success Secrets of Black Millionaires” and “Think and Grow Rich: A Black Choice,” we now have the power to build wealth. No-one can stop us from achieving our financial goals. He writes that we must purpose to see beyond the injustices and strive to build wealth, regardless of the obstacles thrown our way.

The Entrepreneurial Spirit

Dr. Kimbro interviewed several black millionaires, and the recurring theme to their achieving phenomenal success was, “Believe, persevere, and never give up.”

In a podcast on TrailBlazers.FM, Dr. Kimbro summarizes his talk on, “The 7 Laws of Creating Wealth” by stating that:

1. Attitude: Wealth begins in the mind but ends in the purse

2. Choice and Action: Decide that you will not be poor. A little bit less talk and a little more action. Don’t share your dreams with naysayers

3. Believe: Have faith in God and yourself, when no one else will

4. Self-discovery: Find your unique gifts and areas of excellence. Pour your whole heart and soul into discovering what gives you a sense of wholeness and fulfillment

5. Service: Pay the price for the space you occupy by serving people. Volunteer freely and also provide for-profit services.

Realize: Q+Q+MA=C. The Quality of your service + the

Quantity of your service + the Mental Attitude in which

it was rendered = Compensation.

6. Entrepreneurship: Own your business. An entrepreneur solves problems and serves people. Solve a small problem, make a little money. Solve a big problem, make a lot of money

7. Repeat your successes: Make your money grow even more

In order to build wealth, long term planning is a good start, and commitment to the plan is vital. Regardless of your age, consider implementing the following strategies.

Building wealth in your 20's

While the older generations might seem to have it together, you have something in your 20s that they lack; time. A solid financial foundation built in your 20s will put you ahead of the game. You’re young and energetic, with millions of possibilities ahead of you. What you do with your money in your 20s will have a lasting impact on your future.

Pay off debt and avoid debt

Avoid unnecessary credit card debt like the plague, as you could rack up debt that’ll deplete your financial resources for more than a decade. Useless debt is money spent on acquiring trendy designer outfits, flashy electronic gizmos, clubbing, etc. Avoiding debt in your 20s makes your 30s stress and debt free.

Strive to clear student debt and any other debt. If you do not use your credit card in a disciplined manner, e.g., to build up your credit score, get rid of it, and use alternative payment methods!

Live Below Your Means

For the average twenty-year-old, the urge to live large is strong. Be frugal and avoid wild spending. More often than not, living extravagantly will lead you to debt. Your 20s are your foraging years when you gather supplies for the long winter coming: retirement.

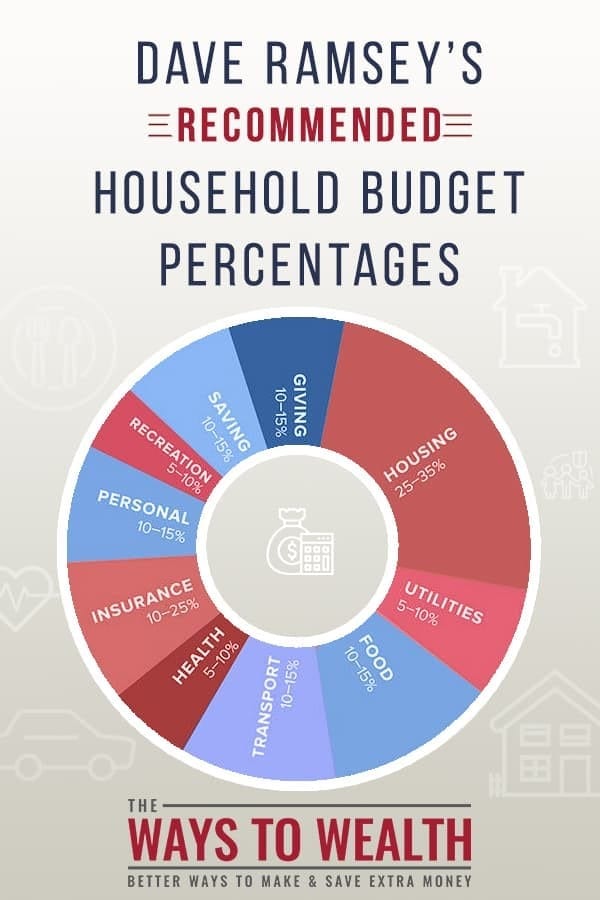

Living way below your means will enable you to save much more. The more you spend living it up, the less you save, reducing your base of wealth. Having a strict budget inclusive of all your monthly needs will go a long way to meeting your savings goals. A budget ensures that a sizeable amount is saved and invested, all your needs are taken care of, and debts paid off.

For the most part, your living standards should be modest during your 20s. Expensive cars, spacious houses, and luxury trips should be acquired later in life.

Grow Your Wealth

With the eradication of debt, invest in stocks or equities, bonds, money market, real estate, or other appreciating assets. Current USA college debt levels make investing in your 20’s very difficult. However, if investing is a financial possibility, aim for the stars! Investing is truly the simplest way to grow your wealth.

Seriously consider an entrepreneurial venture that gives you net profits of even 25%. Now that will definitely increase your wealth!

There aren’t any rules as to when you may begin investing. Some have invested in stocks and slowly made their way out of poverty, while others have started businesses and gained their financial independence. Consider carefully what method will work best in your particular situation.

Be careful to clear any outstanding debts and purpose to avoid obtaining new debt. Obtain gainful employment and save up money to invest and or begin an entrepreneurial venture.

Saving, and the power of interest

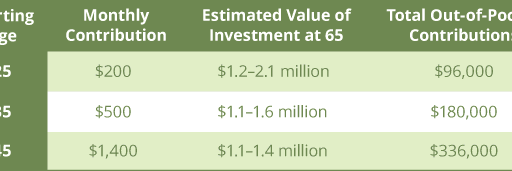

Take advantage of your 20s and start saving asap. If you start investing, say $200 every month when you’re 25, depending on the interest rates, at 65 you’ll have up to $1.2-2.1 million saved up for your retirement.

To achieve the same result at 35, you’d need to save $500 per month. At 45, you would have to save seven times the amount to get $1.1-1.4 million on retirement!

Saving money in your 20s and earlier, helps you cultivate financial discipline. You will save more than you’ll be able to in later years.

Make a habit of putting aside at least 10% of your income towards retirement and 5% towards emergencies, e.g., medical, unemployment, etc. Do not start saving money towards retirement until you have an emergency fund with three months’ worth of savings.

Please note, when you factor low-interest rates, inflation, and taxes, savings do not substantially increase your wealth. Saving money simply ensures that you’ve safely stored money for a raining day.

Building Wealth in Your 30's

The 30s come with more responsibilities and more needs, all of which translate to more bills. Saving seems more difficult with all these daily expenses. Always save a percentage of your money, before catering to your expenses.

· Acquire real assets. Purchase tangible assets such as housing and watch your housing budget. If buying cash is not an option, spend no less than 25% of income on a 15-year fixed interest mortgage. Consider purchasing houses to flip and sell, or for rental income.

· Have an emergency fund. Saving 15-20% of your total monthly income should be your primary goal. Having enough money to cover a couple of months’ expenses will give you a cushion to land on during hard times. An emergency fund will prevent you from dipping into your retirement fund or going bankrupt when an emergency eventually hits.

· Maximize your retirement. Open a Roth IRA account, and fully fund it in conjunction with a 401(k). You may open a Roth IRA account at a bank or brokerage.

Roth IRA income limits for 2019

Filing status | 2019 modified AGI | Maximum contribution |

Married filing jointly or qualifying widow(er) | Less than $193,000 | $6,000 ($7,000 if 50 or older) |

$193,000 to $202,999 | Contribution is reduced | |

$203,000 or more | Not eligible | |

Single, head of household or married filing separately (if you did not live with a spouse during year) | Less than $122,000 | $6,000 ($7,000 if 50 or older) |

$122,000 to $136,999 | Contribution is reduced | |

$137,000 or more | Not eligible | |

Married filing separately (if you lived with spouse at any time during year) | Less than $10,000 | Contribution is reduced |

$10,000 or more | Not eligible |

Building Wealth in Your 40s

Post-retirement, you may wish to maintain your lifestyle. Therefore, you will most likely need to save up enough money to replace more than 80% of your earnings. According to recent statistics from the Economic Policy Institute, people aged 44 to 49 averaged retirement savings of $81,347. Quite frankly, this amount doesn’t cut it at all.

While it may seem like precious time is running out when you hit your 40s, there are still measures you could take to plump up your retirement package.

· Consult a finance professional. Make sure you have taken the best plans. You must save at least 15-20% of your annual income. Preferably, this should be in retirement accounts with tax advantages such as a Roth IRA or a 401(k).

Do regular checks to ensure that everything is up to code. For an even heftier retirement package, increase your monthly contributions every time you get a raise.

· Avoid borrowing any money from your retirement funds. As was mentioned before, an emergency fund is a big must. Borrowing from your, e.g., 401 (k) will derail your savings plans. You’ll have first to clear the loan before further contributions can be made to the 401(k).

· Increase mortgage payments. If you still have a mortgage, double down on making payments. At this stage, you need to free up your income as much as possible to save up for your retirement.

Building Wealth in Your 50s

If you’re in your 50s, without savings and no retirement plan, you need to play some serious catch-up. Still, all is not lost for there are measures you could take to ensure a comfortable retirement.

· Annual contributions. Catch-up on your inputs. You may contribute an extra $1,000 annually, for a total of $6,500 each year in your Roth IRA, and you can invest as much as $25,000 in your company’s 401(k).

· Hold off on claiming your retirement benefits. They can be claimed as late as 70. Waiting to withdraw your social security will raise your monthly benefits, and you will receive more money each month if you wait till your full retirement age.

Health insurance. Having medical cover is crucial, especially at this age. A medical complication could throw your finances in disarray and set back your retirement plans.

The 50s are typically associated with reduced expenses as people hit the height of their careers and head toward retirement. People also earn their most when in their 50s. They are at their most mature and are clear-headed about their goals. Entering this final stretch at a sprint will allow you to maximize your retirement when your income is at its peak.

Closing the Gap: Uniting for Equitable Black Generational Wealth

Let’s stand up for fairness, rewrite the rules, and create a world where everyone has a real shot at success.

Bridging the Wealth Gap: Efforts Towards Equitable Solutions

Introduction: Bridging the Divide – Understanding the Wealth Gap A Persistent Disparity in Wealth: Unveiling the Divide The landscape of the United States is characterized

The 4 Essential Tools You NEED for Audiobook Narration

It doesn’t have to be expensive. No need for fancy bells and whistles! It only needs to work.