- Minimum Deposit: What is FxPro?

- Is FxPro a good Broker?

- FxPro Minimum Deposit and Trading Platform

- Different FxPro Accounts and Charges

- Other FxPro Essential Services

- Why choose FxPro Minimum Deposit?

- Bottom Line

Minimum Deposit: What is FxPro?

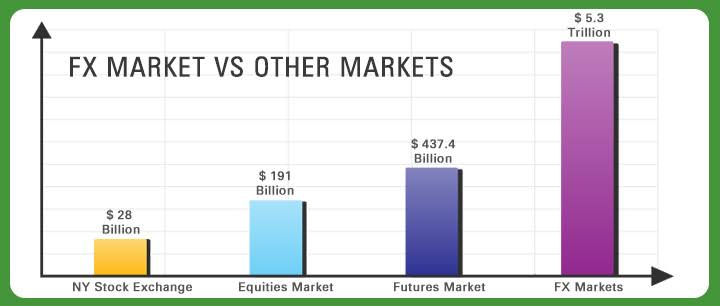

Before we dive into FxPro minimum deposit, it is important you understand what FxPro is all about. FxPro is a Forex, CFD and Spread Betting Broker established in 2006 with head office in the United Kingdom. The company is registered and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. Securities Commission of the Bahamas (SCB), Cyprus Securities & Exchange Commission (CySEC) and Financial Sector Conduct Authority of South Africa (FSCA) also regulate FxPro. It provides high quality access to financial markets; shares, metal, indices, futures, energies and commodity CFD products through advanced execution model. As part of her corporate responsibility FxPro is the official Main Sponsor of Yacht Club de Monaco and official partner of McLaren F1 TM Team.

Is FxPro a good Broker?

FxPro has a global reputation for excellence and innovation. Through years of excellent professional service delivery, FxPro provide comprehensive access to financial markets. You can access online trading with CFDs on 260+ instruments in 6 asset classes. With FxPro you can trade Forex on a range of different platforms, including MetaTrade4 and MetaTrade5. You can start for free with FxPro demo account. This company also has a multilingual customer service team to provide you with an exceptional level of support.

FxPro Trading Platform

It has a wide range of platforms, such as FxPro MT4, MT5, mobile trading applications and proprietary trading applications. FxPro offers a good variety of trusted, award winning platforms and account types to choose from. Investors have exclusive access to trading tools, news and analysis.

FxPro Awards and Achievements

FxPro has been in the online trading services since 2006 and currently operates in 173 countries worldwide. Record shows that it has 1,300,000 client accounts at the moment.

Recognition are synonymous to FxPro. How? The company receives recognition regularly in the industry and has over 75 international awards for the quality of its services. These awards include: 2019 Best Forex Trading Platform, Shares Awards, Best Fx Provider 2020, Online Personal Wealth Awards, Best in Class MetaTrader Broker 2020 etc. They have a good reputation in the industry as a trustworthy and reliable broker. The company adhere strictly to international best practices. FCA, CySEC, FSCA and SCB regulates her activities.

FxPro Minimum Deposit and Trading Platform

You can open an account for free with FxPro demo account. However the FxPro minimum deposit for opening a trading account is $100 with no commission. As a recommendation, FxPro suggests that you deposit at least $1000 for you to access the best experience of their service. This is not mandatory. There are also some FxPro minimum deposits options which depends on your account type.

The following will apply as FxPro minimum deposits on your accounts:

MetaTrader Account

The FxPro minimum deposit on this account type is $100. You can trade with MetaTrader 4 and MetaTrader 5 platforms with this account.

cTrader Account

The FxPro cTrader minimum deposit is $1000 with 1:500 leverage. Commission fee applies.

Edge Account

The FxPro Edge account is still in the beta stages of release because it is relatively new. At present it is only available to UK traders. The minimum deposit is $100.

VIP Account

This is for high level traders and minimum deposit of $50,000. It has the best spread rates with lower commissions.

Market Account

The minimum deposit for FxPro Markets is $500 and 1:500 leverage. FxPro offers the best when it comes to the range of multi-assets to trade from compared to others in the industry.

Is it Possible to Lose more Money than the Minimum Deposited?

FxPro offers Negative Balance Protection (NBP) for all clients, irrespective of their categorisation & jurisdiction. This ensures that you cannot lose more than your total deposits.

Also FxPro provides a stop-out level, which causes trades to close when a certain margin level % is reached. This stop-out level depends on the account type and your jurisdiction.

Trading Platforms in FxPro

FxPro provides investors with a wide range of desktop, web and mobile trading platforms. This includes FxPro platform, MetaTrader 4, MetaTrader 5 and cTrader.

FxPro MetaTrader4 platform is very popular and offer classic solution. Traders considers this trading platform as the standard in the industry. Most brokers use this platform because of the comprehensive range of tools and features integrated into the platform. MetaTrader 4 platform support multiple languages and users can customize the platform interface with their preferred language. Another significant feature of MetaTrader4 is its ability to support multiple order types. The most important feature of this platform is the trading automation. Because you can program MT4 platform efficiently to execute trades by itself. This automated execution of trades are based on the trading parameters you have set with the help of Expert Advisors (EAs).

The MetaTrader4 platform is considered as the most important for brokers, since it can provide traders with in-depth information about the trading markets.

MetaTrader5 is an updated version of MetaTrader4 with some upgraded features. If you want to trade with raw spreads choose cTrader platform. Because the platform design support traders to access spot markets using interbank rates, and enables efficient ECN trading. The FxPro Markets platform is intended for traders who trade directly from the desktop or tablets without making any downloads. Markets platform in FxPro permits multitasking within the platform.

Different FxPro Accounts and Charges

This company offers a variety of account types for you to choose from:

MT4 account with instant execution and fixed spread.

Another MetaTrader4 account is MT4 account with Instant execution and floating spreads.

The third MetaTrader4 account is MT4 account with market execution and floating spreads.

cTrader account with market execution and floating spreads.

MT5 account with market execution floating spreads.

VIP Premium Account

VIP Premium Accounts are for selected individuals with high deposits ($50,000 or equivalent) and clients actively trading with large money. Benefits are free VPS service and the possibility of decreased spreads/commissions.

Can I open a Corporate Account?

Yes you can open a trading account for your company. To open a trading account on your company name use the regular FxPro sign-up procedure. You will enter the personal details of the company representative and then log into FxPro Direct to upload official company documents. Some of the documents you will upload are certificate of incorporation, articles of association etc. Your application is reviewed by FxPro Back Office Department and approved if your application is successful.

FxPro Swap-free Accounts

This account type are for traders around the world who may be unwilling to pay daily swap fees for religious reasons. For these swap-free accounts there is no swap or rollover on overnight positions. Benefits of this account type are: No swap fees on spot indices, futures and shares. No increase on minimum deposit requirement.

FxPro Premium and Standard Account

The FxPro minimum deposit to qualify for a premium account is $50,000 to trade investment. Premium account holders enjoy more benefits than the standard account holders. The major difference is the lower spreads that a premium account holder will enjoy when trading with large volumes of money. Standard accounts are divided into four types. The FxPro MT4 and MT5 have an FxPro low minimum deposit and a leverage of 1:500. It consist of several financial instruments such as Forex, Indices, Metals, Energies and Futures.

When deciding on an account type to use, you need to consider these three things. First the product(s) you wish to trade and trading conditions. Secondly the execution type and finally, the features and capabilities of the platform itself.

FxPro Demo Account

The FxPro demo account is provided for free to potential traders. This account type gives the opportunity to learn and experience the FxPro platforms before using real cash to trade. With the FxPro demo account, you have access any FxPro trading platform such as cTrader, MT4 and MT5. After you sign up for the account you will receive a virtual cash balance of $500,000. You can use this money to trade on the FxPro demo.

FxPro Charges

FxPro charges a fee from the spread. This fee is the difference between the sell and buy price of a particular instrument of trade. Traders are liable to trading costs in the form of commission charges and spreads. cTrader platform users pay a commission of $45 for every $1million trade, in addition to the spreads. If you look at the industry’s Forex broker comparison, FxPro commission charges and spreads are very competitive.

There are different methods you can use to deposit and withdraw cash. These include: Bank wire transfer, Union Pay, Credit/Debit cards, PayPal , Neteller, Skrill and E-Wallet. There is no charge for withdrawals, and withdrawals usually take one business day to process. It can take up to five working days to complete the entire withdrawal process.

FxPro Account Opening

Due to regulations of the FCA (Financial Conduct Authority) and CySEC, a few basic compliance checks have to be passed by the client. This compliance check is done to ensure that you have a full understanding of the risks involved in trading. And also acts as your pass ticket to start trading. Make sure you have the following at hand: A scanned copy of your government registered national I.D., driving license or passport. Also a bank statement or utility bill for the last three months, showing your address.

To open a FxPro account there are basic compliance questions to confirm how much experience you have in trading. After few minutes account opening process is over, you will be able to explore the FxPro trading platform. But however, you not be able to conduct any trades until you have passed the compliance test. This could take several days.

Other FxPro Essential Services

Mobile Trading

Just like the web based and desktop platforms, the FxPro app trading platform is third-party developed. This platform comes with native features, but some areas of the platform are not native. These features are execution and pricing models, reporting and other features that cannot be customised. Mobile platfotm navigation is intuitive and easy just like web based platform. This mobile application is highly rated among many other mobile apps used for trading.

MT4 and MT5 Version

The mobile version of MT4 and MT5 platforms are standard and contain native features. However, you can customise features such as news feeds, pricing, execution model and reporting. The mobile versions of FxPro MT4 and MT5 are the same with the FxPro desktop configuration settings. All functionalities you need to research and analyse trading opportunities are in the FxPro mobile app. You can as well track your account using “advanced order”, just the same way you do it on the desktop. With the mobile application you can also create and manage watch lists.

FxPro Customer Service

Customer support services are available in 23 countries. The customer support service of FxPro is always available through phone, email and online chat when the markets are open. On FxPro web pages the chat based support feature displays via a persistent link.

Self Support Service

Available on FxPro’s support web page is self-support which has a searchable archive and knowledge base. This provides solutions to most questions about FxPro order types, minimum deposit and trading platforms. The FxPro Contact Us page is one of the best because it contains the phone numbers and emails of each department separately. The right department receives the questions intended for them and professional answers given.

Furthermore, the customer support platform is available in about 20 languages and you can customize it to fit you appropriately. FxPro customer support service is available from 11.00pm Sunday night to Friday midnight in most time zones; five days a week and 24 hours a day. This gives a guaranteed efficiency.

FxPro Learning Tools

Available on FxPro is a wide range of trading tools and educational content. Comprehensive learning environment for the basics in forex trading is available on FxPro trading academy. You can be prepared for the trading challenges that you are likely to face on the international currency markets. Access short, insightful and informative videos on basics of trading in the FxPro library. The videos will give you comprehensive information on general trading tips and strategies. Plan your investment strategies wisely with the economic calendar tool. You have access to the current economic reports. Consensus forecasts and the volatility are available as well.

The learning tools available at FxPro will guide you on how to create an easy trading plan, and to learn the strategies of risk management. Learning makes it easier for you to identify available investment opportunities and work on them when necessary. You can download other educational articles that are downloadable in the PDF format, to learn even more. Finally the FxPro demo account is also part of education. Demo account enables you to practice the trading theory after going through the videos and PDF literature. With FxPro demo you can trade with virtual cash. This enhance your feeling of reality in trading education.

Why choose FxPro Minimum Deposit?

Beside the popular low FxPro minimum deposit of $100, trading Forex works efficiently with FxPro. The FxPro unique features serves traders in an adequate and efficient way. Some of the key features that give FxPro a plus are the transparency and reliability, unique trading tools, multiple support languages and a readily available FxPro demo account.

There is guarantee for your money and investments. Its stability is based on the several jurisdictions that regulate this broker. Because of certain restrictions FxPro does not offer Contracts for Difference to the USA, Iran and Canada residents.

Bottom Line

Trading financial products comes with a high risk most especially trading leverage products such as CFDs. They are not suitable for everyone. Before you make the minimum deposit make sure that you fully understand the risks. Consider if you can afford the risk of losing your money before investing.

CFDs are complex financial derivative instruments. You trade on margin. It is risky to trade CFDs and may not be suitable for all investors. Ensure you understand the risks involved as you may lose all your invested deposit.

It is important you note that trading securities carries substantial amount of risk. And profits are not always guaranteed. The educative materials and tools, methods, indicators and techniques will provide profitability if used accurately. As an investor, you don’t need to be scared. You should know that risk is the opportunity, so sign up, meet the minimum deposit for FxPro account and create the opportunity to achieve your financial goals. Once again before you trade, consult a trader!