- Introduction

- What is the Best Trading Platform for CFD?

- CFD Trading Versus Others

- How Can You Trade CFDs?

- What Are the Benefits of CFD Trading?

- Frequently Asked Questions

- Is CFD Trading Legal In The United States?

- Conclusion

Introduction

The term CFD stands for Contract for Difference. It is a trading and financial derivative instrument which allows you to advantage of price changes of financial assets, without having to own them yourself. CFD alongside other types of common assets like Forex, commodities and spot metals are offered by brokers and there is no asset ownership transferred by a CFD. Profits and losses are strictly based on the price change of the underlying asset.

This agreement between a broker and a trader to exchange the difference in the value of a financial asset contract between the opening and closing of that contract is known as Contract for Difference (CFD). You need to identify a good broker and CDF trading platform to succeed at CFD trading.

What is the Best Trading Platform for CFD?

Finding the best CFD trading platform for you depends on many factors, but it’ll be easier to figure out the right platform if you’re familiar with CFD trading in the first place.

What is a CFD?

CFD stands for a contract for differences. It’s a contract that offers traders and investors the option to profit from the price movement of assets without actually owning them. CFD investors only receive revenue based on the price change of the asset because CFD trading is a form of price speculation. Also CFD investors or traders only owe money for the same reason.

How Does it Work?

Let’s try to break down this concept into one you can understand. For instance If there was a stock with an asking (open) price of $20, you could open a CFD for 200 shares’ worth of value. This would have a normal value or cost of $4000.

CFD brokers however require low margins, usually around 5%. As a result, a CFD investor can enter a trade for the above shares with only $200. And if the price of the CFD is higher, you’ll end up making money. You’ll make less, if it’s less.

Leverage in CFD Trading Explained

When trading CFD it is possible to control a large position in an asset without offering up the full cost of that position because you’re trading with leverage. For example you want to open a trade on 1000 shares of Apple. In a traditional trade to purchase these shares you would have to pay the full cost for the shares. But because you are trading using a CFD you might only need to put up 5% of the full amount of the trade.

CFD trading is different from regular stock trading because of the way leverage is applied. In the stock trading and economic field, leverage is best understood as an amount of debt you or another investor can take on to increase buying power. Stocks normally require you buy into trades with low leverage. This actually refers to a low amount of debt you can take on any given deal.

Leverage allows you to spread your capital out and employ it more efficiently, but remember that the total profits and losses are still calculated based on the full position size. In our example with Apple shares that means your profit or loss is still 1000 times the difference between the prices when you open the trade and when you close the trade. This can increase profit and losses substantially, and it is possible to suffer a loss that’s greater than your full deposits. This makes it important for traders to fully understand leverage and to keep a close attention on any trade using leverage to ensure it doesn’t get out of control.

Margin in CFD Trading Explained

A better way of trading with leverage is by understanding the term margin. In CFD trading platform the small deposit needed to open the larger position is referred to as the margin.

There are two kinds of margin in CFD trading. For you to open a position a deposit margin is necessary, and once the trade is open there is a maintenance margin amount that is required to ensure that the position will not go below what the funds in your account can cover. If your loss does get larger than your deposited amount you will receive a margin call from the CFD broker asking you to make an additional deposit to cover the potential loss. The CFD broker can close your position if you fail to meet this margin call by depositing additional funds and any losses will then be realized.

Spread in CFD Trading Explained

CFD brokers (brokers who you trade CFD through) make money on the “spread”. Spread is the difference between the buying and selling price of the CFD. This happens automatically with most CFD trading platforms; as an investor enters a trade, and the account for the CFD immediately produces a small loss equal to the size of the price difference.

Short and Long CFD Trading

The ability to speculate on price movements in either direction is one of the advantages of CFD trading. This implies that you can match a traditional long trade in which an asset is purchased, and you can also match a short position that profits when the price of the underlying asset falls.

As an example, if you believe the is going to be a fall you could sell a CFD based on gold. And If the price of gold falls you will profit when you close the short position, but if gold price rises you’ll suffer a loss when closing the short position. Profit or loss is only realized when the position is closed regardless of whether your position is long or short.

Hedging in CFD Trading

In CFD trading platform one of the less used applications for CFD trading is in hedging existing positions to manage risk. For example if you already own Apple shares but think the stock is due to fall because of adverse market conditions, or a disappointing quarterly earnings report. In an attempt to protect yourself from the drop in the share price you could go short with Apple CFDs. If the price does drop as you predicted the gains made on the CFDs will offset any unrealized losses in the actual shares.

MT4 and MT5 Trading Platforms

MetaTrader 4 and MetaTrader 5 platforms are complete with the latest charts and tools to help you progress your CFD trading strategy. You can use the platforms to trade CFDs across shares, indices, commodities and cryptocurrencies.

MetaTrader platforms are complete with updated tools for market analysis to give you a smooth, user-friendly CFD trading experience.

CFD Trading Versus Others

CFD Trading vs Stock Trading

Stock trading can only take place when at least one of the individuals actually has a share or some ownership in a company. Stock trading happens when shares of that company are sold for money or for other stocks. CFD trading is not like this because neither party actually owns the underlying asset.

CFD Trading vs Forex Trading

Forex trading is basically pure currency trading in contrast to CFD trading that covers a much broader markets, such as;

cyptocurrency, energy, metals, indices, and more. CFD trading platforms are often included alongside Forex trading by brokers.

CFD Trading vs ETF

In ETFs ( Exchange-Traded Funds) there is actual ownership of certain underlying assets like futures, bonds, stocks, or even real assets like bars of gold. They are treated like common stocks.

If you are looking for a passive investment that is likely to grow reliably over time ETFs are better option. While CFD trading is more about agile motion and making profits or loss based on market changes or short-term predictions.

CFD Trading vs Options

An agreement that gives a trader a right to buy or trade an asset at a certain price in the future regardless of the price at that point is know as an Option in the stock market. For instance, a trader with an option for a stock at $20 could buy that stock for $20, even though the market price is now at $50. Therefore, Options are also contracts but they’re a different type compared to CFDs.

How Can You Trade CFDs?

Decide a market that you want to trade in – there are different type of CFDs, like Forex, metals, cryptocurrencies and more.

Decide the position size you want to trade in and open a deal using a broker. You’ll put money down and open position on a CFD.

Observe the position as time goes by.

Stick to an exit strategy. This implies closing the deal when you make an acceptable profit or when you lose enough to make wise withdrawal.

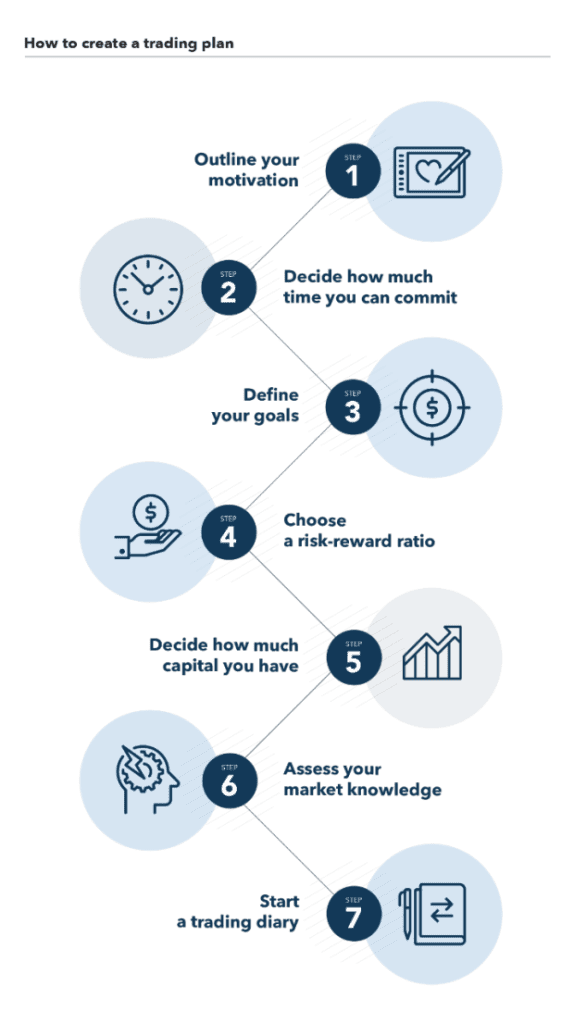

How to create a CFD trading plan

You can buying a CFD at a low price and sell it once the price raises. This is the simplest example of this type of trade and is not all that different from regular stock trading that takes place over the short term.

What Are the Benefits of CFD Trading?

CFD trading has much higher leverage than traditional trading, so it’s appealing to those without a lot of capital or traders who can take much risk. This equally makes CFD trading very accessible.

Secondly CFD trading takes place across a variety of markets that run essentially 24 hours a day. Compared to traditional trading, CFD trading isn’t very expensive and moreover most brokers don’t charge high fees. This type of trading is easy to start and you can get addicted to it.

Thirdly, CFD trading doesn’t require very high day trading conditions; many accounts only require that you put down in your account about $1000. The opportunity is here for you to create great wealth trading CFDs.

What Are the Risks?

CFD trading is innately riskier than other types of trading because of the amount of leverage involved. Unlike most other types of trading, CFD trading isn’t so regulated for starters. One of the reasons that it’s banned in United States. Therefore, it is very important that you choose a good broker and CFD trading platform if you want to succeed through this trading method. Just like leverage, there are also margin risks. This relatively small margins can add up over time when you have multiple open positions on CFD trades.

Frequently Asked Questions

What is a CFD Broker?

CFD broker is a type of trade broker that specializes in contracts for difference. These brokers charge a commission on transaction. This commission is a percentage of the profits based on the size of the transaction. Most of the CFD brokers also make money through the quoted spreads on every market. Thus they technically make some profit every time you enter into a trading deal with them.

Is CFD Trading Taxable?

In general CFD Trading is a taxable income and within EEA CFDs are subject to capital gains. However if you are UK residents, you can take advantage of Spread Betting. Because Spread Betting is exempted from both taxation and stamp duty.

Can CFD Expire?

CFDs does not expire because they are not traded in a regular stock exchange. CFD trading don’t have expiration dates that will require you buying or selling the underlying asset at a certain price.

Is CFD Trading Safe?

CFD trading is innately riskier than other types of trading because of the amount of leverage involved and the general risk associated with the stock market. But many CFD trading platforms are regulated and on the digital front have an enhanced security that makes it safe. Take time to have a good understanding of how CFD trading works before investing.

What Is a “Stop”?

A stop is a preset order to sell a position when it falls to a certain price irrespective of your feelings at the time. This is an invaluable tool when you first start out because it helps cut your losses and minimize your risk. Limit orders are used to instruct your trading platform to close a CFD trade at a price that’s better than the current market level in conjunction with Stops.

What Are Trading Jurisdictions and “Tier” Levels?

Collections of countries in which CFD trading occurs are known as jurisdictions. These jurisdictions have different (tier-based) security ratings where higher numbers indicate lower trust or security. While lower numbers indicate higher trust or better security. For instance a tier-1 jurisdiction (America) is better than a tier-2 one (Russia).

How to Buy CFDs?

You need a certain amount of money to open a position. This is like a collateral or a set minimum amount of money you have in order to be accepted for a deal. For instance, a bank may not give out a loan to someone who doesn’t have $5000 in their bank account. CFD margin also works in the same way.

What is a CFD Pair?

Simply CFD pair is a pair of contracts for difference. You can pair your trade by buying one instrument and selling another instrument at the same time. If you read the charts and want to make a strategic alteration to your plan, you can trade CFDs of similar value to change your position.

How long can I hold a CFD?

There is no actual expiry date for CFDs and as a result they can remain open as long as possible. But leaving the position open after the market close can incur fees known as swaps in Forex currency pairs or a rollover in CFDs. It would be at your own advantage therefore to calculate possible swaps in advance and project it onto your expected return.

Is CFD Trading Legal In The United States?

CFD trading is unfortunately been banned in the United States and citizens can’t to take advantage of this excellent trading opportunity. United States citizen are prohibited from opening CFD accounts domestically and on foreign platforms by both the Securities & Exchange Commission (SEC) and the Commodity Commission (CFTC).

CFDs are deemed illegal in the United States in part because they are considered over-the-counter (OTC) trades that don’t pass through regulated exchanges. Securities & Exchange Commission (SEC) and the Commodity Commission (CFTC) are also worried about excessive losses due to the use of leverage in CFD trading. Regulators in European countries have tackled this issue with use of leverage by limiting CFD brokers to offering leverage not greater than 30:1 unless a trader is an approved professional trader.

Conclusion

CFD trading have continued grow in popularity over the past decade partly due to its ease of operation and accessibility. It’s a very distinctive financial instruments with several merits over traditional markets such as the ability to go long or short, low commissions or fees, lower margin requirements, higher access to leverage, no day trading or scalping rules, and easy access to a broad range of global assets from a single account. Of course, there are some demerits such as the potentially large spreads and the chances of large leverage can occasion costly losses, but by far the merits outweigh the demerits of CFDs.

The bottom line is that, CFD trading platforms and broker have a big impact on whether you’ll be successful in your CFD trading adventure. Contemplate your choices carefully to maximize your chances of profit. Some of the CFD trading platforms grant you access to different CFD assets, while others enable you to operate in different countries.

Pingback: CFD Finance and Asset: An Overview