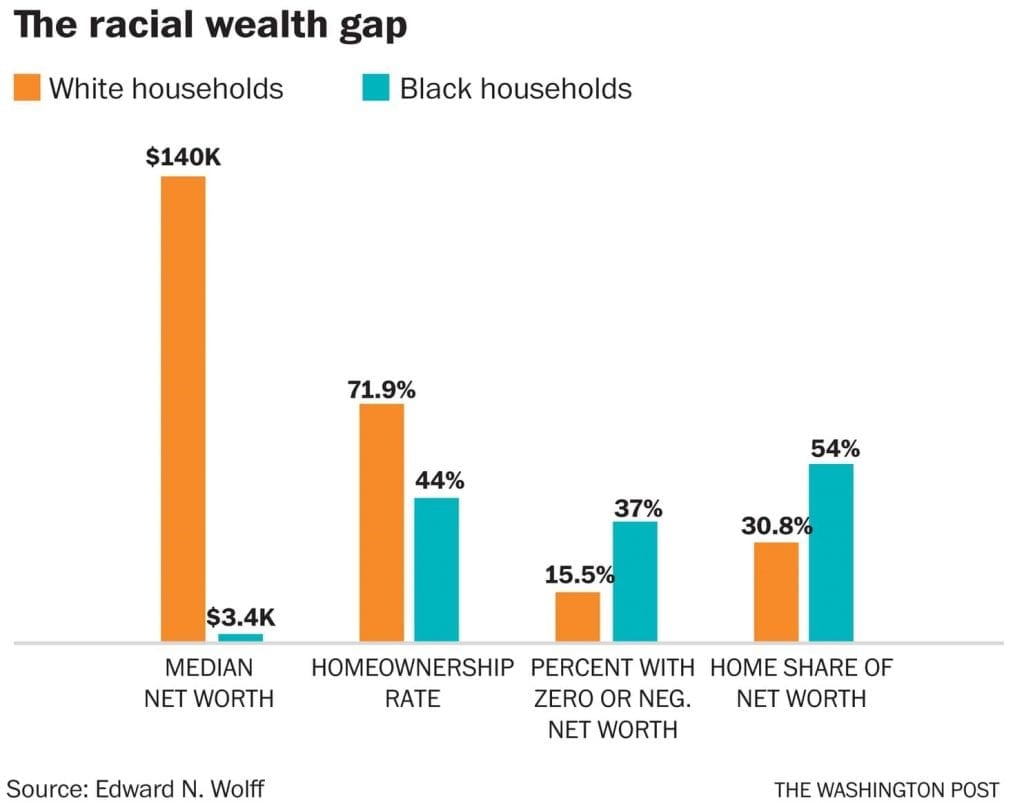

African captives arrived in Virginia over 400 years ago and were sold as slaves to white plantation owners. Since then, systematic inequalities have ensured that African-American wealth is a fraction of their white counterparts. In a report written by the National Bureau of Economic Research, in 2016, the median African-American families net worth was $3,400, compared to the $140,000 net worth held by median white families. Truly abysmal!

To understand why black families have found it incredibly difficult to acquire wealth and pass it on from generation to generation, one has to acknowledge the damage caused by systematic obstacles.

Let’s take a walk through history.

Institutionalized Economic Discrimination Against African Americans Since Emancipation

Considering US Government bills and other race-based exclusionary tactics, it is clear to see that environmental factors pertaining to the creation of wealth have been unfavorable to blacks. Few were able to thrive in such harsh conditions, but even for those who did, their wealth was hardly ever safe

- Cases of whitecapping, where blacks were chased out of town and all their wealth stolen, were rampant and not prosecuted. The Land Act of 1785 gave Congress the power to transfer land to white citizens on the most favorable of terms

- The Homestead Act of 1866 was written in favor of ex-slaves. It focused on transferring land to black private farmers. However, due to poor implementation and racial discrimination, it lost steam and petered out. Later attempts by black politicians to have it enforced were met with stiff and opposition.

- The New Deal, a discriminatory housing policy, was initiated by the federal government in 1933. Following the Great Depression, President F. D. Roosevelt sought to ease the financial burdens of American families by providing affordable housing. While well-intentioned, this new policy was a good deal for only white upper, middle, and lower-class families.

White families enjoyed a substantial increase in homeownership, while black families were forced into “urban housing.” Due to employment opportunities and segregated neighborhoods, black families were herded into basic apartments and houses located mostly in the inner city.

The federal Home Owners’ Loan Corporation (HOLC) and the Federal Housing Administration (FHA) was guilty of discriminating against the African American community when they;

- Refused to insure mortgages in or near predominantly African American neighborhoods. The HOLC and FHA went so far as to create city maps which indicated black “no-lend” neighborhoods, in bright red. This practice is popularly referred to as “redlining.” The HOLC and FHA distributed these maps to mortgaging companies, effectively shutting out African Americans from obtaining government-subsidized loans that would have allowed them to purchase land and build homes

- Subsidized construction companies and created housing covenants, prohibiting these companies from selling houses to African Americans. The mass-produced subdivisions could only be owned and occupied by white complexioned families. The companies were explicitly forbidden from selling to African American families.

Some property deeds included instructions preventing the resale of properties, to black families, up to 100 years! The Supreme Court outlawed this practice in 1948, but it took decades for municipalities to enforce fair property sale practices

- Pressured private lenders, insurance companies, and construction companies to prioritize white clients and not provide loans to African Americans. Afraid of being blacklisted by the federal government, these private companies rejected African American applications en mass

- World War 2 public policies, responsible for asset creation, were not inclusive of blacks. The G.I Bill, in particular, has been credited for the creation of the white American middle class. One of the many postwar policies launched by the American government, the G.I Bill benefited from aggressive financial backing. According to historians, thanks to the G.I Bill, more money was spent on education in the USA, than was spent on rebuilding Europe by the Marshall Plan.

Unfortunately, this policy excluded African Americans, robbing them of much-needed opportunities. Segregation and other racial discrimination practices at the time ensured that African Americans were prevented from utilizing USA government policies. It is apparent today as it was then, that these policies were created for the betterment of a select group of Americans.

Other notorious causes of the racial wealth disparities include;

Occupational steering and income inequality: This occurs when companies opt not to employ African Americans, or when employed, prevent them from achieving managerial posts. Discrimination in the workplace also causes pay discrepancy, where an equally educated and experienced black person is paid thousands of dollars less than a white employee. STEM companies are particularly vulnerable to these discriminatory practices.

Statista provided data showing that from 1979 to 2015, the wage gap between the races increased from 18.1% to 26.7%.

- Outright discrimination: Violence based purely on race

- Educational segregation: African Americans attended segregated schools, which provided them with sub-standard education. They were shut out of institutions of higher learning, until faith-based organizations, e.g., The African Methodist Episcopal Church, Baptist, and Catholic churches, formed Historically Black Colleges and Universities (HBCU’).

These educational injustices were corrected with the desegregation of schools. On May 17, 1954, the US Supreme court, via The Brown v. Board of Education decision, ruled segregation unconstitutional and ordered that African Americans be admitted to all educational institution. However, enforcing it was an uphill climb. Those that were admitted to predominantly white schools were mistreated and prevented from graduating. When they did graduate, many weren’t given diplomas or degrees as was the case with white students.

Interestingly enough, as recently as 2014, the Associated Press reported that there were 43 desegregation lawsuits by the U.S Justice Department, in Mississippi alone! In 2016 a federal judge in Mississippi had to order the desegregation of the Cleveland School District.

It goes without saying that federal standards made it much easier for white families to build equity and generational wealth over the years, while it made it all but impossible for African Americans to achieve the same.

A credit to African Americans; against all odds, we have overcome.

Aspire to Be Wealthy

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

INFLATION FIGHTERS

THESE ANTIDOTES TO A RISING CPI ALL HAVE STIFF COSTS OR OTHER DRAWBACKS.

| STRATEGY | ANNUAL

EXPENSES,

| HAZARD | TAX TREATMENT2 |

| FOREIGN EXCHANGE3 | 76 | COSTS | BAD |

| GOLD ETF4 | 26 | NEW SUPPLIES | TOLERABLE |

| HOME5 | 20 | REAL ESTATE CRASH | VERY GOOD |

| JUNK BOND ETF6 | 40 | DEFAULTS | DREADFUL |

| MORTGAGE7 | 20 | DEFLATION | GOOD |

| REAL RETURN FUND8 | 73 | DEFLATION | TOLERABLE |

| RESOURCE STOCKS | 0 | BUSINESS RISK | TOLERABLE |

| SOCIAL SECURITY POSTPONEMENT | 0 | CONGRESSIONAL DOUBLE CROSS | GOOD |

| TIPS | 0 | RISING REAL RATES | BAD |

| TREASURY LADDER | 0 | HYPERINFLATION | BAD |

1ANNUAL HOLDING COST PLUS A TENTH OF ROUND-TRIP TRANSACTION COST. ASSUMES TREASURYS BOUGHT AT AUCTION. A BASIS POINT IS 0.01%. 2IF ASSET IS OUTSIDE A TAX-SHELTERED ACCOUNT. 3COST SHOWN IS FOR POWERSHARES BEARISH DOLLAR ETF. 4ISHARES GOLD TRUST. 5REALTOR AND CLOSING COSTS ONLY, APPLIED TO A PORTION OF HYPOTHETICAL SALES PRICE. 6SPDR HIGH YIELD. 7CLOSING COSTS ONLY. 8FIDELITY STRATEGIC REAL RETURN.

- Invest: With a decent amount of money, a prudent investor can grow their wealth through purchasing stock, real estate, starting entrepreneurial ventures, mutual funds, money markets, treasury bonds, etc. for the betterment of the generations to come

- Secure the future: e.g., having a retirement fund, providing a debt-free college education for their children, etc.

- Avoid useless debt: A wealthy person does not need to use their credit card to purchase winter clothes, food, or pay rent. Any debt that is not incurred in the process of obtaining a real asset is a deterrent to becoming wealthy. A wealthy person has a good credit score that enables them to avoid predatory loans or any to other debt that will keep them a slave to never-ending high-interest payments

Influence politics and lobby groups: We need African American leaders to occupy every political office possible, starting with the Presidency (Obama!), Vice Presidency, Senate, House of Representatives, and state Governors, etc. Election campaigns and political lobbying require millions of dollars. Without powerful lobbyists and political leaders, a community is considered weak and unimportant.

So, the wealthier a community, the more powerful they are. The Jewish people and their uber-powerful lobby groups have taught us a vital lesson in this regard! While Jews are a teeny fraction of the American and world populace, no one dares mess with them!

The Generational Wealth Pledge for Black Families

In the United States, white families have successfully passed on their wealth from generation to generation. Internationally, royal families and European business empires have grown and sustained their wealth over centuries, prevailing against world wars, market crashes, and economic depressions.

Read more on the principles for generation wealth creation here [TeeJayTrue “Principles for Generation Wealth Creation]

Motivated by the desire to see black families and their generations prosper financially, Lamar and Ronnie Tyler of blackandmarriedwithkids.com, started the movement “Generation Wealth Pledge for Black Families.”

To participate in the movement, one has to affirm solemnly:

I pledge to…

- shift my money mindset from spending to building wealth

- regularly check my credit score to ensure that it’s at least 740

- calculate how much I will need to retire and to contribute to a retirement plan

- plan for my children’s education

- awaken the financial genius of my children

- rely on more than one source of income for building my wealth

- consistently allocate at least 20% of my income to my savings

- leave my family a legacy

- consciously support black-owned businesses and boycott businesses that discriminate and dehumanize the black community

In their documentary “Generation One: The Search for Black Wealth,” Ronnie and Lamar interview financial experts who provide strategies for building a strong family legacy.

Essential strategies for developing a wealth-building mindset and enhancing generational wealth are:

Eliminate “the Joneses” mindset

Do not keep up with the Joneses by making unnecessary purchases. Stop competing with your workmates, friends, and neighbors. Overcome any sense of inadequacy or insecurity by developing a healthy sense of sense

Understand that self-worth cannot be purchased from historically racist institutions

Centuries of being treated as second-class citizens have led to a number of us living beyond our means. We buy items we can seldom afford, to prove our “black purchasing power.” Our humanity will not be established by purchasing useless trinkets and incurring excessive debt. These showy purchases deplete our savings, and as such, lower our net worth.

Stop being foolish. Stop trying to prove your worth to people who have gone out of their way to hate you and discriminate against you.

Redefine “the good life.”

Deeply reflect on what wealth means to you. Does your comprehension of wealth go beyond the hype and bling lifestyle created by reality TV shows? Wealth is all-encompassing. Be monetarily wealthy and also be wealthy in love, good deeds, community involvement, rest, internal peace, friendship, and creativity. Real wealth brings about considerable satisfaction and fulfillment.

Distinguish your needs from your wants.

It is okay to splurge on something that you like but making a habit of it will only render you broke in the long run. Practice financial self-control. Self-denial in the present will lead to an even better lifestyle in the future.

Cultivate a spirit of gratefulness

Practicing gratefulness is as exercising a muscle. Once you learn to be thankful for what you already possess; you can attract greater and grander things.

Become financially literate

Increase your education in personal finance. This can be achieved by reading financial articles, hiring a financial coach, and having an accountable and supportive group of wealth-minded associates. Sign up for affordable online programs which train you how to manage your money, e.g., Dave Ramseys Financial Peace University https://www.daveramsey.com/fpu#in-progress=0

Strategize to generate wealth. Learn how to write proposals, business plans, budgets, and acquire an enhanced understanding of taxes and other essential financial systems. Reduce your debt and obtain a better credit score, which will ensure greater leverage for your business.

Teach your children financial principles; saving, hard-work, investing, etc. Set up businesses for them or invite them to work at the family business. Inspire them and show them that they too can be wealthy.

Dr. Dennis Kimbro, author of The Wealth Choice: Success Secrets of Black Millionaires says, “I can tell you unequivocally wealth is not a function of gender, not a function of race. It is not a function of circumstance. It is not a function of condition—how the cards were dealt, which side of the town you were born on, but it is a function of choice, a function of discipline, and it is a function of effort, faith, and believing in yourself.”