- Introduction

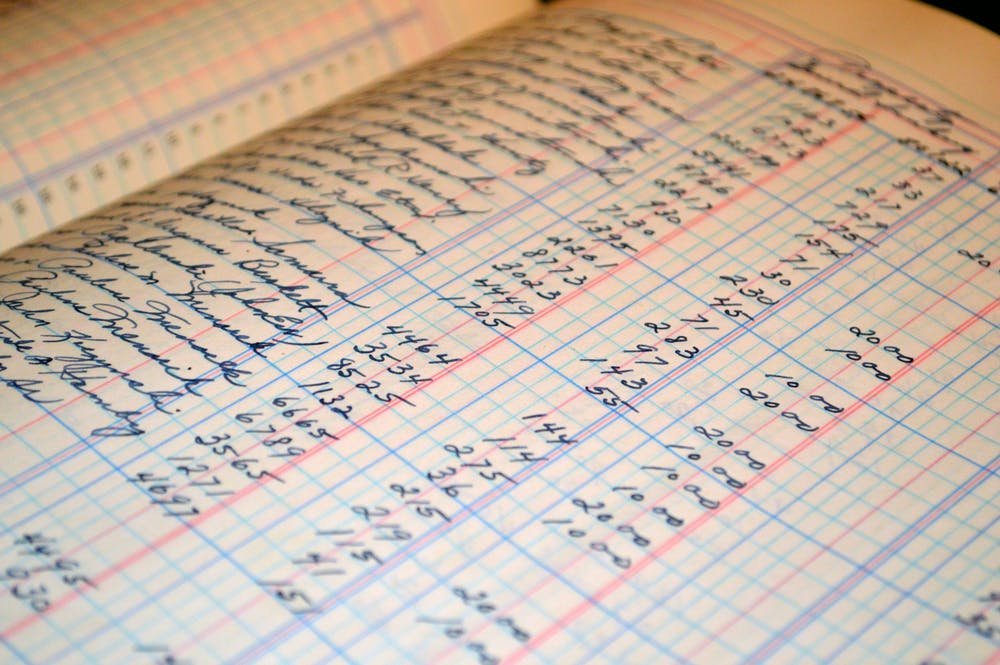

- Basic bookkeeping

- Benefits of professional bookkeeping services

- How do I know when I need a professional bookkeeper?

- Importance of good records

- Bookkeeping and dealing with a tax accountant

- Selecting a tax accountant and preparing records for use

Introduction

A little basic tax and bookkeeping will go a long way to keep your business more organized and profitable. It is good as a business owner you understand the importance of tax and bookkeeping and how to find a professionals to help you.

If you really need to succeed in business, you need to understand financial management. It doesn’t matter how good you are at creating a product, providing a service, or even marketing your yourself. The money you are earning will just slip between your fingers if you don’t understand how to efficiently collect it. Keep track of it, how to save it and how to spend or invest it wisely.

Poor financial management is one of the major reasons that businesses fail. In most cases, failure could have been prevented. If the owners had just applied some sound financial principles to every dealings and decisions. Financial management is not what you can just leave to your banker, financial planner or tax accountant. You must understand the basic principles yourself and be able to use them on a daily basis. Even when you plan to leave the complicated work to a hired professional.

Basic bookkeeping

Well, in order to succeed in business, one of your major tools is financial analysis that’s based on your business records. Accurate financial records will always help you answer some important questions, like:

- Do you make money, or lose it? How much?

- Is your business on a sound financial ground?

- Any financial trouble lurking ahead?

A sound tax and bookkeeping system is the very foundation on which all your valuable financial information will be built. As a business owner, you might probably rely on an outside accountant to handle your taxes and prepare your financial statements. However, like many small business owners, you might find it too expensive to pay a tax accountant to handle the routine bookkeeping chores. Someone in your compan, probably you, need to take on the responsibility of keeping an accurate set of financial records. Fortunately bookkeeping software will make this task very easy than you may have thought.

Nevertheless, to find the right tax accountant is an important element for you to monitor and manage the financial well being of your business. To have an expert third party review your records, means that you’ll be very alerted to problems with your bookkeeping methodology. It’s better that you have your tax accountant tell you this, instead of the IRS.

Benefits of professional bookkeeping services

Before we look into some of the benefits of you having a professional keep your books. Let’s discuss about your bookkeeping options. First, you might be a bookkeeper professional yourself, but that will take you time and efforta. Spreadsheets full of numbers basically aren’t very thrilling for many people. Your second option will be to hire an in-house bookkeeper, which could be costly. The third option will be to outsource your bookkeeping needs.

So why then should you even consider professional bookkeeping services? You won’t bother yourself to look at rows and rows of numbers for hours on end. Let’s look at the several additional benefits.

Bookkeepers provide a professional touch

Bookkeepers have a lot of experience with accounting and financial software. They are capable of troubleshooting issues and discrepancies as soon as they are arising. They will equally help you to make payments on time to prevent late fees and ensure that you understand the latest financial regulations.

Enjoy better work life balance

As a business owner, you will spend your workdays to focus on the important aspects of running your business. This means that bookkeeping responsibilities are always an afterthought. Many business owners will end up taking care of these tasks at home in the evenings. Probably spend their weekend going through accounts because something isn’t adding up? Outsourcing a bookkeeper will reduce this stress and will help you keep work from spilling into your personal life.

Saves time and money

Recent studies has it that, depending on the size of your business and the frequency of financial transactions. You may be spending anything from 20 to 120 hours on tasks related to bookkeeping each year. That’s the time you could have spend on your core business needs and total development and growth. Let alone your basic daily job requirements.

Outsourcing your bookkeeping needs for hassle-free taxes

In general, bookkeepers will help you reduce some of the hassle and worry during the tax season by working with your tax preparers.

How do I know when I need a professional bookkeeper?

Probably to manage your financial accounts and transactions take up a large chunk of your time at work or spill into your personal life. Then it’s time for you to consider a bookkeeping service. Or, you have to block off hours of your week, by gritting your teeth and a pot of coffee before you can sit down and keep your books. Know it’s time to outsource. Do any of the statements related to you or your business?

Your books are consistently outdated

Does your financial records often out of date? Do you have to wait till the end of the year right before tax season before you even look at your accounts and books? Find a professional that will keep you up to date. Not only will you be able to avoid late fees, but you’ill equally be able to catch issues sooner. And have a perfect understanding of your business performance.

It gives you headache

You need to save yourself the headache. If bookkeeping is a thing that you truly dread, know that you will spend a little time on it as possible. Which might lead to inaccuracies and will cause you even more headaches.

Bookkeeping takes hours of your time each month

If managing your accounts and financials do take more time than you want to spend. Outsourcing will certainly free up your time for other business or even personal pursuits. Bookkeepers are known to have the experience in handling accounts and finances and they will maintain your books with greater efficiency.

You frequently fall behind on paying and collecting bills

Do you store your bills and receipts haphazardly? Do you have difficulties to find financial documents you need and keep up with payments? A professional bookkeeper will organize all your financial data and pull out documents and reports for you when you are in need of them. This will help you to keep track of your bills and payments.

Importance of good records

Except your business is accounting or bookkeeping, to keep financial records is not what you will do best. Most likely, you will instead spend your time selling your product or service. However, if you really need to run a successful business, an accurate and timely financial information is important. Let’s look at some of the reasons why you really need a good financial bookkeeping system:

To monitor the success or failure of your business

It’s difficult to know how your business is doing without you having a clear financial picture. Do I make money? Are my sales increasing? Do my expenditures increase faster than sales? Which expenses are high based on my level of sales? Do some expenditures seem to appear out of control?

Provide the needed information in order to make decisions

To evaluate the financial consequences need to be a part of every business decision you make. Without these accurate records and financial information, it might be difficult for you to know the financial impact of an action. Will it be profitable to hire another salesperson? How much will a new production employee cost? Is this product line profitable?

Obtain bank financing

Usually a banker will like to see financial statements. That’s the balance sheet, income statement, and cash flow budget for the current and prior years. Together with your projected statements that will show the impact of the loan requested. A banker might even like to see your bookkeeping procedures and documents. To assess whether you run your business in a sound and professional manner.

Obtain other sources of capital

If your business has really reached the point where you need to partner with someone. Any prospective partner will really need to be intimately familiar with your financial picture. If you source for capital and are thinking to take in an outside investor. You will need to provide a lot of your financial information. Even your suppliers and other creditors might ask to see some financial records. Such information will be produced by your outside accountant, but it is based on your daily tax and bookkeeping.

Budgeting

All businesses need to use a budget for planning purposes. A budget will help to keep your business on track by forecasting your cash needs and to help you control expenditures. Additionally, if you are to seek bank financing or other means of capital. A banker or prospective investor will need to see your budget as an evidence that your business is well planned and stable. You need to have solid financial information to be able to prepare a meaningful budget.

Preparing your income tax return

It doesn’t matter if your business is a sole proprietorship, partnership, or corporation. You are expected to file an income tax return and equally pay income taxes. With a good record, to prepare an accurate tax return will be very easy and you will be more likely to do it on time. Poor records will result to you to underpay or overpay your taxes and or file late. If your tax accountant is the one preparing your income tax return. Poor records will certainly result to you paying higher accounting fees. Probably your business is a partnership, you not only prepare a partnership tax return. But you will prepare partnership return amounts will be passed directly to the tax return of each partner.

Complying with federal and state payroll tax rules

Payroll tax deposits need to be made according to strict deadlines. Late payment of payroll taxes will result in severe, and unnecessary, penalties. Equally, you have to file a payroll tax return quarterly, which you will reconcile with the payroll deposits that was done during the quarter. Towards the end of the year, you will be required to give your employees and the government W-2 forms, which will tally with your quarterly payroll returns.

Submit sales taxes

When you collect sales tax from your customers, a good record will make it very easy for you to compute the tax due and equally prepare the required reports.

Distributing profits

When your business is a partnership, certainly you will need a good record to determine the accurate amount of profits to distribute to each partner. If you operate as a corporation, you will determine your company profits that you will pay out as dividends to shareholders.

Bookkeeping and dealing with a tax accountant

In many cases, with a study and familiarization of your bookkeeping software. You will be able to manage your basic financial records without the help of any accountant. This will include the daily recording of your transactions, maintaining of a general ledger, and maintaining of your cash records. There are other records you might need to maintain, that depends on your business. Like accounts receivable ledgers and accounts payable ledgers.

You might need a tax accountant that will help with tax and bookkeeping routine tasks. Like to prepare periodic adjusting entries, financial statements, closing entries and income tax returns. As well as to help you prepare a budget. You might equally decide to have your tax accountant set up your books when you first opened your business. It will help to find an accountant who’s very familiar with, and a fan of, the software you will prefer. Probably you’ve been in business for a while. Your tax accountant should be able to give your tax and bookkeeping procedures and records a one time checkup.

Bookkeeping and outside accountant considerations

If you decide to use an outside accountant, how often will you be needing their services? At a minimum, you will be needing your accountant to help you close the books yearly. To be to handle your tax planning services and your income tax return annually. If you have financial statements prepared, you will need them to be done at least annually. However, annual financial statements might not be enough to assist you in keeping tabs on your business. You might need financial statements quarterly, or even monthly.

This depends on the size of your business, you might need to have your accountant close the books monthly, particularly when you need to submit monthly sales tax to the state.

Selecting a tax accountant and preparing records for use

If you don’t have any accountant, you should look around for one just as you would do for any other service provider. Discuss with your friends in your business community about their own accountant. Conduct an interview with different candidates. And ask yourself the following questions:

- Do they specialize in businesses of my size?

- Do they recommend software I like? Will they help me in setting up my bookkeeping system or optimize my current system?

- Are they adequately able to understand my business and its unique problems?

- Do they specialize in income taxes?

- Are other business people familiar with this very accountant?

- Have they received any positive recommendations from my peers in the business community?

- Did the tax accountant explain the fee structure to me? Am I okay with it?

- Do they communicate in a way I like to conduct business?

- Am I okay using this person as my business CPA tax advisor?

Are Credentials Important?

Some accountants do seek a professional designation to set themselves apart from others. Certified Public Accountants have attained the “CPA” title by going through a rigorous examination that covers accounting, business law, auditing and taxes.

Many business owners are comfortable when they choosw a CPA as their tax accountant because, as a rule, they will feel it assures them of a high level of professional competence. Some non-CPA professionals might not have a broad education as a CPA. But an individual can have a perfect accounting and tax expertise for your business. Don’t wait till the deadline to start looking for an accountant. Try to do it in advance of your need for they services. Equally, the worst time to hire an accountant is within the “busy season” (January through April). Tax accountants generally won’t have time for interviews during this time of year.

Get your records ready

You may save yourself some cash by doing much of your own bookkeeping as possible. Your accountant might like you to drop a shoe box full of receipts and records in their office. Such a strategy will cost you too money in accounting fees. You don’t necessarily need to pay your accountant for routine clerical work. You should ensure to keep track of your daily transactions, and have a preliminary general knowledge of your finance

Promptness counts

Get all your records ready and book an appointment with your tax accountant as early as you can. Don’t wait until you are very close to an upcoming deadline. If you will get your records to your tax accountant early, they will give you better service for your money. Don’t like some people that wait till the last minute, don’t be one of them!

Pingback: The Real Cost of Flipping Houses - Generational Wealth Now