Wealth Building Strategies

It is possible to build wealth by implementing an effective financial strategy. Building personal wealth will help you send your children to college, start a business, purchase an affordable home, and put money away for retirement and a rainy day. You can achieve your financial freedom through controlling debt, building credit, budgeting, investing, and saving money.

Let’s start by defining wealth.

Some people define wealth as:

- The ability to afford fancy cars and an opulent mansion

- The ability to comfortably pay bills on time

- The ability to take luxury trips around the world

- The ability to control your work and rest schedule and not be a slave to the “system.”

- The ability to pay for your children’s college education, out of pocket

To be clear, this article talks about financial wealth and what strategies you can use to build wealth. Building wealth requires good planning, the right information and making wise choices. This article strives to provide you with a systematic approach to increase your wealth, through time honored principles, that is – budgeting and saving, investing and building credit.

Financial Lingo for Wealth

If you want to learn about growing your personal wealth, the very first thing that you should do is learn the basics of financial language and wealth creation.

Understand what assets, liabilities and net worth mean, i.e., ASSETS – LIABILITIES = NET WORTH

An asset that creates wealth is one that provides a return, or increases in value, such as:

- Savings accounts

- Retirement plans

- Stocks and bonds

- Having a profitable business

- Owning a house etc

Some possessions, for example, a car, clothes, and household furnishings, are assets but are not “wealth-creating” because they neither rise in value nor earn money. A car will depreciate as soon as it leaves the car lot, clothes lose value as soon as they are worn, and so do household furnishings, with the exception being antiques. A car is useful because it takes you from point A to B, but unless it is used in business (e.g., Uber, rent-a-car, etc.), it does not create wealth.

A liability, also referred to as debt, is the money that you owe, for example:

- Home mortgage

- A car loan

- Credit card balances

- Hospital and medical bills

- Student loans

Wealth Building with Home Equity

When talking about homeownership, the market value of a house is an asset, while the mortgage is a liability.

For example, your house is valued at $120,000, but you have a mortgage of $80,000. This means that your home equity is $40,000. Your net worth comprises of equity, among other considerations.

In essence, net worth is considered your wealth because it is the difference between what you own (assets) and what you owe (liabilities).

Budgeting

Set Financial Goals

Self-made millionaires and billionaires did not build their empires overnight. They instead got wealthy by setting financial goals and attained them by working smart and hard.

Set short term goals, e.g.,

- Save $3,000 per year for 3 years, in order to have $9,000 for a house down payment

- Add $500 per year to your emergency fund

Set long term goals, e.g.,

- Save $25,000 over 15 years, for your children’s college education

- Save and invest so as to have $5,000 a month when you retire in 30 years

When making short term and long term goals, ask yourself, “What do I want my net worth to be three years from now? Ten years from now? Etc.”

Develop a Budget and Stick to The Plan

The main difference between those that attain their financial goals and those that don’t is good planning and action (success), versus poor planning and wishful thinking (failure). Doers put action towards their goals, and are therefore more likely to achieve their dreams.

A doer will:

- Track their spending

- Live within their means

- Strictly follow their budget

- Pay off credit card debts promptly

- Save money in a savings account monthly

- Make regular retirement savings contributions

A budget will enable you to:

- Understand where you spend your money

- Avoid overspending

- Put money aside for investment and savings purposes, to build wealth

Writing up a budget is straight forward. All you need to do is:

- Calculate your total monthly income

- Track ALL your daily expenses

- Determine how much you spend monthly and reduce unnecessary expenses, e.g., fancy dining

Track Day-to-Day Spending

Look at how much you earn and how you spend your money. Track your daily spending, whether by debit or credit card, cash, or check. Set a goal to save, e.g., $125 per month, to go towards your wealth creation goals.

Create a Monthly Budget

From the information derived from tracking your day-to-day spending, develop a monthly budget. You may discover that you’re spending more than you earn, meaning that you are building debt and not wealth.

So, to achieve your monthly saving goal of $125, you may need to earn more money and or cut your expenses. Therefore, you could work overtime, and increase your pay, buy fewer clothes, discontinue premium cable TV channels, save on gas by carpooling to work, and reduce your entertainment and dining out expenses.

If you follow the above plan, you should be able to obtain $125 to:

- Pay off debt

- Put in a savings account

- Start a 401(k)-retirement plan

- Invest in an IRA – Individual Retirement Account

- Invest in mutual funds, bonds or stocks

- Start an online business!

Save and Invest

With proper budgeting, you will be able to identify the amount of money that you can save. The question “where will I put my savings?” will, therefore, arise. By investing some of your savings, you will be putting your money to work, thereby increasing your wealth.

Unlike savings that just sit in the account and earn a measly monthly interested percentage, an investment (e.g., stocks and bonds) offers higher earning potential. Investments increase wealth by appreciating (growing) in value or by generating income (dividends or interest).

Get Guidance

Gather information and conduct thorough research. Good investments will make you money, whereas bad investments will cost you money. Obtain advice from registered or licensed financial advisors. Also, read financial magazines for current financial information.

Take Advantage of Compound Interest

Compound interest is one of the simplest ways to help build wealth. Compound interest is when interest is paid on previous interest amounts, in addition to the interest paid on the original investment. For example, a $5,000 investment that earns 6% interest over a year, may make $308 if compound interest is applied monthly. Therefore, in five years, the original $5,000 investment will increase to $6,744. Compound interest is for the patient investor because it increases investment over a long period.

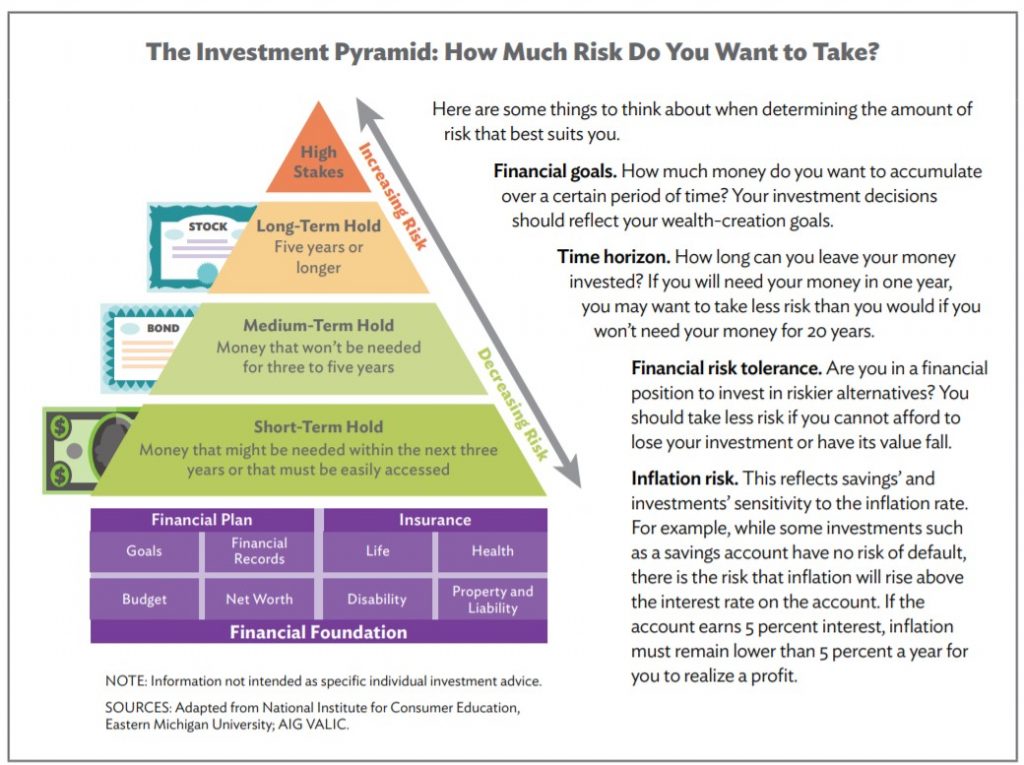

Understand Risk and Return

When saving or investing money, the amount of expected return is mostly based on the amount of risk that the investor is prepared to take. Generally, the higher the return, the higher the risk – of losing money. On the flip side, with reduced risk, an investor should expect a lower yield.

For example, saving money in a financial institution is deemed a “safer” investment than investing in the stock market. A savings account of up to $250,000 is insured by the FDIC (Federal Deposit Insurance Corp.) and receives a minimum interest yield of 0.09% and up to 2% for online savings accounts.

Meanwhile, you can grow your money on the stock market, even double $250,000 to become $500,000 on a good day. However, investments in the stock market are not insured, and you could equally lose all your money, just as you could double it! Money invested in the stock market may have its’ value reduced if the investment does not perform as expected. A healthy stock portfolio will have an average annual return of 10%, which is way more than what you get from a savings account.

Use the investment pyramid below to balance your savings and investments and to ascertain the reasonable risks you are prepared to take. Move up the pyramid only after you build a strong financial foundation.

Tools for Saving

Open a savings account at a credit union or bank because of FDIC insurance. A savings account is typically used by investors because one can:

- Make use of compound interest, with zero risk

- Store their money safely in a financial institution, versus in their office safe or home

- Monitor their balance online

- Get direct deposit of their paycheck

Financial institutions offer different interest amounts and a variety of insured savings accounts. The average institution should provide a:

- General savings account. This account earns interest, allows immediate access to funds, and permits movement of money from one account to another

- Money market account. This account earns interest and may have check-writing services. MMAs usually do not impose fees with a minimum balance

- Certificate of deposit (CDs). This is purchased for a specified term. After the end of the term, the principal will be returned, in addition to the interest. Early withdrawal penalties apply to CDs.

Tools for Investing

With a good savings foundation, diversify your assets by putting your money in different types of investments. Diversification helps reduce risks by considering the adage, “Don’t put all your eggs in one basket.” Be smart and take a long term view of your investments. You may invest in:

Bonds – Lend Your Money

When you purchase bonds, you lend money to a municipality, state or federal agency, or other issuers e.g., corporation. A bond in financial terms is the equivalent of IOU. The issuer pays you a stated rate of interest during the lifetime of the bond and repays the entire investment when it matures.

There are various types of bonds:

Savings Bonds

United States savings bonds are government-issued. It is one of the best investment avenues, albeit with low-interest yields, because you cannot get less than you put in. U.S government bonds are insured and can be purchased in amounts ranging from $50 to $10,000.

There are additional differences in the features of the various types of savings bonds.

For example, those that are indexed for inflation, e.g., Series I bonds. An investor receives a fixed rate of return, considering the annualized rate of inflation. Be careful to register your paper USA savings bonds at Treasury Direct in case you misplace your paper copy

Treasury bills, bond, notes, and TIPS

The U.S Treasury sells these bonds in order to pay for U.S. government activities. They are backed by the credit and faith of the federal government. Treasury bills have maturities of 3, 6, or 12 months.

Treasury notes are securities that bear interest and have maturity terms ranging from two to ten years. Interest payments are made every six months. TIPS (Treasury Inflation-Protected Securities) keeps pace with inflation, so interest payments are adjusted according to inflation.

Some government-issued bonds provide unique tax advantages. For instance, Treasury and savings bonds do not incur state or local income tax. Therefore, higher-income investors purchase these bonds to gain from their tax benefits.

Stocks

Owning stock enables you to become a stock-holder – a part-owner of the company. Stock-holders make money in two ways by:

- Selling stock that has appreciated

- Receiving dividend payments

Learn a company’s financial history before investing. Enquire about its management, financial performance, products, and previous stock valuations. A successful investor is well informed.

Mutual Funds

Mutual funds are a form of stock investment where several people’s funds are polled together and invested in many firms. You become a share-holder of a fund when you buy mutual fund shares. This diversification helps spread risk across numerous companies, as compared to putting money in one company in the hopes that it will perform well. Mutual funds have different levels of risk and associated management fees and costs.

Study a mutual fund’s past performance, the companies that it invests in, how it is managed, and any fees. Read expert reviews about a mutual fund; compare and contrast it with its competitors. Bonds, stocks, and mutual funds may be purchased through abroker or directly from mutual funds and some companies.

Tip: Rule of 72

The Rule of 72 helps an investor approximate how many years it’ll take for an investment to double in value.

For example, $5,000 invested today at 8% interest. Divide 72 by 8 and the result is 9. Therefore, the original $5,000 will double every 9 years. So:

- 9 years = $10,000

- 18 years = $20,000

- 27 years = $40,000

The Rule of 72 also helps you find the rate of return needed to make your investment double.

For example, if you want money to double in 10 years, divide 72 by 10. The result is 7.2. Therefore, with an average rate of return of 7.2%, your investment will double in 10 years.

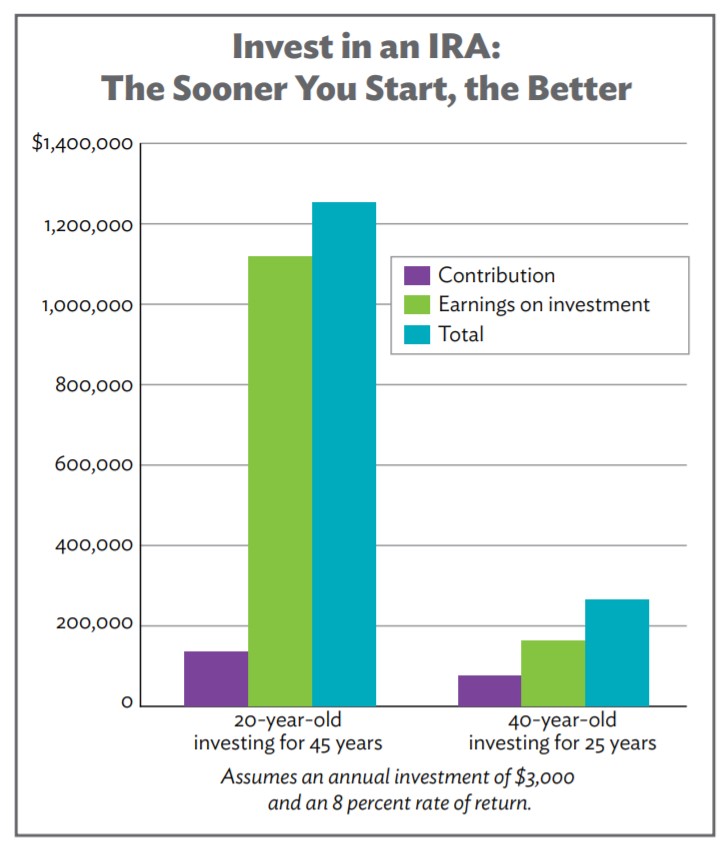

Invest for Retirement

Start saving and investing when you are young and early in your career. A 20-year old who saves $3,000 every year towards retirement, will earn over $1.2 million by the age of 65, assuming an average annual return of 8%. It goes without saying that the saving amounts get lower if you begin investing at an older age.

Image via Dallas Fed

Individual Retirement Accounts

An IRA allows you to build retirement security and wealth. Funds invested in an IRA are tax-free until you are ready to withdraw it upon retirement. You can open an IRA at an insurance company, brokerage firm, bank, or mutual fund. IRAs have specific guidelines as they are dependent on your income level, marital status, etc.

There are two types of IRAs:

Traditional IRA.

This is tax-deferred, meaning that you do not pay taxes until withdrawal. There are also penalties if any money is withdrawn before the age of 59 ½. However, there are a few exceptions, e.g., withdrawing money to pay college tuition fees, cover medical bills or if unemployed, pay medical insurance premiums

Roth IRA

It is funded by an investors after-tax earnings, therefore, the money is not directly deducted from ones income. After the age of 59 ½ , one can withdraw the appreciated value or the principal and any interest tax-free

401(k) Plans

Most major companies offer 401(k) plans in preparation for their employees retirement. Participants authorize their company to deduct a specified percentage of their before-tax salary from their paycheck, and deposit it into a 401(k). Employees are expected to learn about the investment choices offered by the fund. Having a 401(k) plan reduces federal and state income taxes on a paycheck.

Qualified Plans

Don’t worry if you are self-employed. A qualified plan is designed to help those that are self-employed to save for retirement – it is a tax-deferred plan. Check the IRS website for information on tax-deferred investments.

Other Investments

Invest in Your House

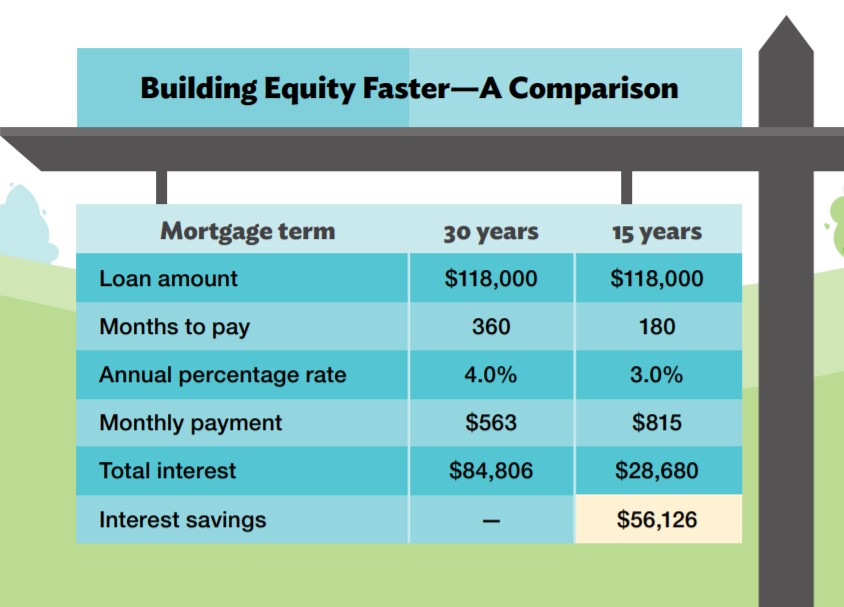

If taking a mortgage, purchase your house with a sizeable down payment so that you can have equity in your home.

Equity is the difference between the value of the home and the balance on the mortgage. As you pay off your mortgage, you increase your equity. Over time, the house may rise in value. Should you choose to sell, you will get more money from the equity.

Building equity quickly will require higher monthly payments but will result in paying less interest. According to the image below, owning your house outright in 15 years will lead to a saving of $56,126. It is possible to pay off a 15-year mortgage with savings, proper planning, and budgeting.

Image via Dallas Fed

Start Your Own Business

As part of your wealth creation strategy, start a business. While risky, it is one of the most preferred ways of building personal wealth. Make a plan, study your intended business, save money, raise capital, and acquire a hopeful entrepreneurial spirit.

There are various business ventures, especially online businesses, that do not require high capital amounts. E-commerce platforms, for example, Shopify and Amazon, allow owners to start their stores with very little investment. You can start an Amazon store with $1,000 which is pocket change when compared to most businesses! Some financial institutions and private angel investors will fund your start up.

When looking at some of the returns of selling products, you will quickly realize that having a business is perhaps the best way to double, even triple your income. A vast majority of millionaires and billionaires made their great wealth from starting a business.

I love the story of Jezz Bezos, who quit his well-paying job on Wall Street to start Amazon.com. Amazon started as an online bookstore and gradually grew into the multi-billion-dollar online store that it is today! So, a simple idea can be the very thing that builds you immense wealth.

Another story is of a photographer who withdrew his Roth IRA, against the advice of his financial manager, to buy a camera for his photography business. I would not advice anyone to divert money from a retirement account for business purposes. However, his risk paid off because he was able to grow his business exponentially. As his business grew, he was able to restart his Roth IRA, and also put money into various investments.

Take a risk, start a business and you could be the newest millionaire, if not billionaire, in town!

Build Credit

Your credit history is important. To be able to qualify for a mortgage, college education loans and so on, you must have good credit. Strive to build good credit and plan to maintain a good score. Good credit saves money, while, bad money costs money.

Pay off your credit debts in a timely manner and reduce debt to have a good credit score – this is the most important part of your credit history.

Know what your creditors say about you. If you have ever used credit, your credit report will show everything about your payment history, e.g., defaults, late payments and delinquencies. A poor record will affect a lenders ability to give you, e.g., a business loan, thereby hampering your wealth creation efforts. The higher your credit score, the less of a financial risk you are.

What’s on Your Credit Report?

Consumers can request annually, a free copy of their credit report from each of the three major credit reporting companies: Equifax, Experian, and TransUnion.