PERSONAL WEALTH MANAGEMENT

Personal wealth management requires above average organizational skills, due to the complexities surrounding managing the wealth of HNWIs (high net worth individuals). HNWIs typically require a holistic approach to portfolio management. HNWIs may have issues with estate planning, investment management, income taxes, and other legal issues that need specific expertise.

Some high net worth individuals may lack the time, or knowledge to manage their finances. So, they seek the services and counsel of personal wealth managers, also known as financial advisers, to manage their money.

A wealth manager helps a HNWI to handle their money so that they have less stress and enjoy more success.

Feel free to follow the seven steps provided in this article to create your plan, or alternatively, get help from a financial advisor.

How to Make a Financial Plan

A financial plan is a document that includes details pertaining to your savings, cash flow, investments, insurance, debts, and other elements of your financial state. A well thought out financial plan removes needless pressure from the wealth management equation. This is because it allows an investor to set and prioritize clear goals, while also mapping out precise strategies to achieve the said goals.

A HNWI and an average earner can make their own financial plans or hire a professional adviser. No matter the route you choose to take, financial planning begins with these steps:

- Set financial goals

- Track expenses

- Get employer matching for savings funds, e.g., 401(k), etc.

- Save up for emergencies

- Reduce Debt

- Invest and grow your income and savings

- Safeguard and grow financial well-being

- Adjust your financial plan

Let’s begin by asking the question

“Do you need financial help?”

Financial planning does not follow a copy-paste, one size fits all strategy. If you need help, for whatever reason, don’t go it alone. There are financial advisors to fit every budget if:

- Seeking portfolio management only, or if

- Needing financial planning and investment advice, or if

- Wanting Specialized help with an in-person advisor

Seeking Portfolio Management Only

Robo-advisors, also referred to as robotic advisors, offer low-cost and simplified online investment management. Computer algorithms design and craft an investment portfolio based on the answers you provide regarding your risk tolerance and the financial goals you set.

Robo-advisors are highly specialized, they use the most recent technology to handle financial tasks that were previously managed by high priced financial experts. The services provided require almost no human interaction and they range from tax optimization to automatic rebalancing.

Robo-advisors monitor your investment mix and recalibrates accordingly, in order to stay on track. Due to its almost entirely robotic setup, getting a robo-advisor is way more affordable than hiring a human investment portfolio manager.

The best robo-advisors for March 2020 are:

- Axos Invest: Best for Overall management

- Betterment: Best for Overall management

- Blooom: Best for 401(k) management

- E*TRADE Core Portfolios: Best for Overall management

- Ellevest: Best for Overall management

- Fidelity Go: Best for Overall management

- Schwab Intelligent Portfolios®: Best for Overall management

- SigFig: Best for Overall management

- SoFi Automated Investing: Best for Overall management

- TD Ameritrade Essential Portfolios: Best for Overall management

- Wealthfront: Best for Overall management

- Wealthsimple: Best for Overall management

Needing Financial Planning and Investment Advice

Online financial planning platforms offer virtual access to human financial advisors. A basic package would provide services like robo-advisors, plus the option to consult with human advisors, should you have other personal wealth management questions. Comprehensive providers or those that provide premium packages mirror services offered by traditional financial planners.

You are usually matched with people who will create a financial plan for you, manage your investments and check-in on you to see if you’re on-track or need some adjustments to the strategy. Personal Capital and Facet Wealth are good examples of the above.

Wanting Specialized Help with an In-person Advisor

If you are a bonafide HNWI or have a complicated money situation, for example, you need a specialist in tax planning, insurance, or estate planning, an advisor in your locality may fit the bill. We recommend fee-only and not compensation-based fiduciaries, i.e., they’ve signed an oath that’ll require them by law to act in your best interest.

Fee-based wealth management firms and advisors charge their clients a percentage of the assets in their care. HNWIs believe that because fee-based advisors receive flat rate pay, they have fewer instances of conflicts of interest, whereas commission-based advisers are known to take unnecessary risks with their client’s money.

Please note, some prestigious and traditional financial advisors reject clients who do not have substantial funds to invest – there are firms who only work with clients who invest a minimum of $250,000.

Regardless of the path you choose to take, the following steps will help you manage your money.

Set Financial Goals

Understand what you want. Make your financial goals inspirational by asking yourself – What do I want to change about my current financial situation? How do I want my life to be in five years? How about in 10, 15 and 20 years? Do I want to purchase a house? Do I want to get married and have children? How do I imagine my retirement years?

Start with goals that inspire and motivate you to complete the next steps and also provide you with a guiding light as you strive to make your dreams a reality.

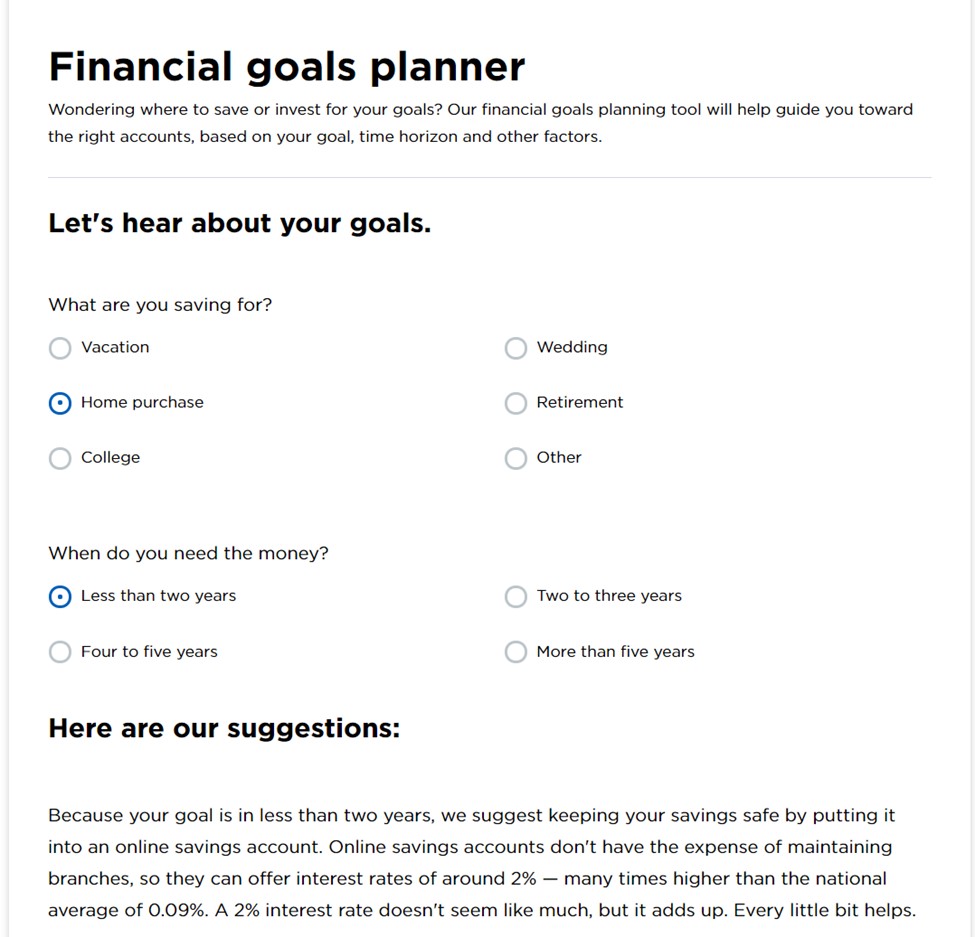

Let’s hear specifically about your goals.

What are you saving toward?

- College education

- Home purchase

- Retirement

- Vacation

- Wedding

- Other

Image: Financial Goals Planner

Track Expenses

Get an accurate picture of your monthly cash flow – what is coming in? What is going out? Making a habit out of studying your cash flow is key to designing a wealth-building strategy and can reveal ways in which to direct more money to debt pay-down and or savings.

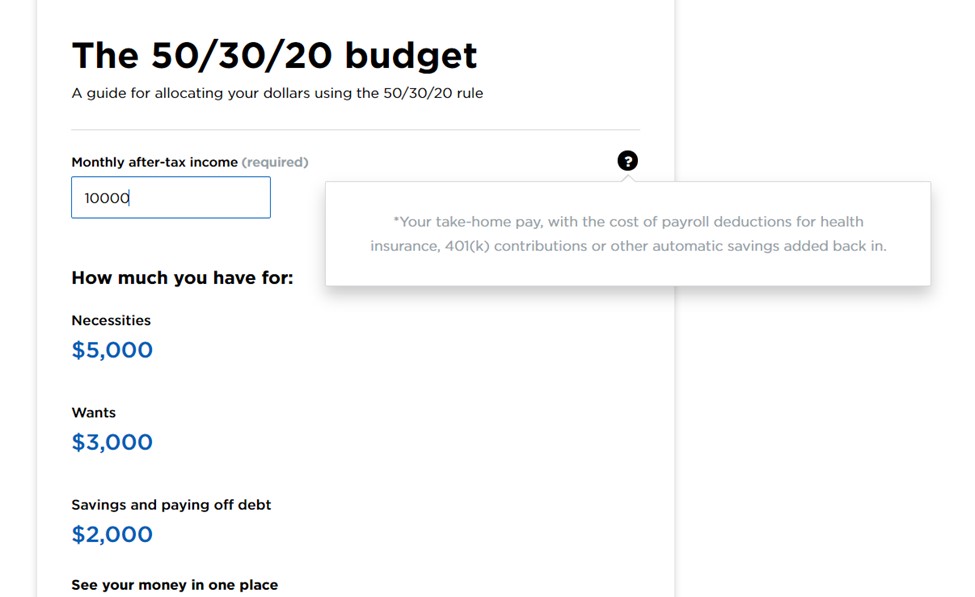

We recommend the 50/30/20 budget principles. In this plan you –

- Put 50% of your after-tax dollars toward necessities, i.e., utilities, housing, transportation, groceries, and other recurring payments

- Put 30% towards wants, i.e., entertainment, clothing, dining out

- Put a minimum of 20% towards debt repayment and savings

We love this plan because it is simple to implement. If you adhere to these guidelines, in the long run, you will have manageable debt and money to indulge in occasionally. You’ll also have a comfortable nest egg that’ll enable you to retire comfortably and also offset unplanned or irregular expenses.

How to Make a Budget

Figure out your after-tax earnings. With a regular paycheck, the amount you receive is your post-tax income.

- If you have automatic deductions for health and life insurance, a 401 (k), and savings, add those to the taxed income to get clarity about your expenditure and savings

- If you have additional sources of income, perhaps you have earnings from side gigs, subtract any amount that reduces it, for instance, taxes and business expenses

Choose a budgeting plan. A well-formulated budget must cover all your needs, some wants and – critically – savings for the future and emergencies. Budgeting plan examples include the zero-based budget and the envelope system. Research various budget apps, forms, etc., to see which one works best

Track your progress and use online budgeting and savings tools

Automate your savings so that the money you have allocated to a specific purpose is deposited with minimal effort on your part

Review and adjust your budget as needed. Your expenses priorities and income will change over time

Get Employer Matching

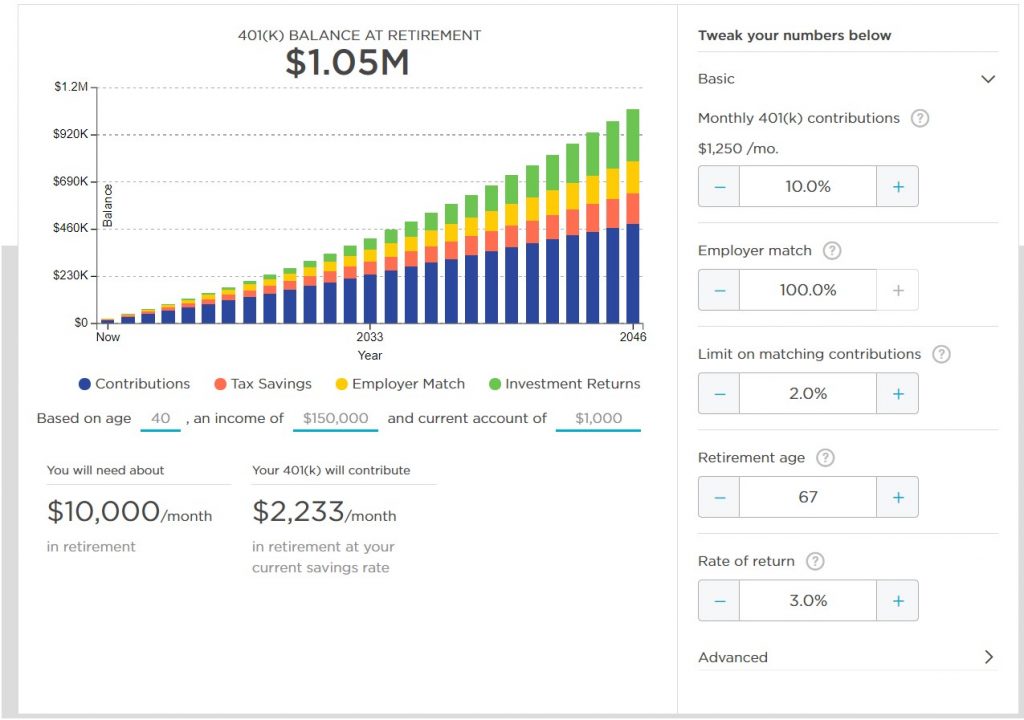

Any financial adviser will be sure to ask you if you have an employer-sponsored retirement plan, e.g., 401(k) and if your employer matches any part of your contribution.

A 401(k)-retirement plan is offered by some employers. It allows you to contribute to the fund directly from your paycheck. 401(k) is an effective and easy way to save and invest for retirement.

There are two types of 401(k)s:

A traditional 401(k).

This is the most common version of 401(k). Typically, your contributions are done pre-tax, and both your contributions and investment earnings grow tax deferred. Taxation will eventually happen on retirement, when the distributions will be taxed

A Roth 401(k).

A few employers offer this variation to the traditional 401(k) plan. In this arrangement, your contributions are made after paying tax, therefore, upon retiring your distributions will not be taxed as income. Your investment earnings grow without having any federal taxes applied

Though 401(k) contributions reduce your take-home pay, they are worthy investments – you get free money from your employer and you save for retirement!

The following 401(k) calculator reveals, with an annual salary of $150,000, how much money you should contribute per month.

Image: 401(k) Calculator

Save Up for Emergencies

Make sure that emergencies do not become unmanageable disasters by putting cash away. Start with savings of $500 to cover repairs and inexpensive emergencies, so that you don’t acquire unnecessary credit debt.

Build your emergency savings fund now and grow it into a larger one in the future. Put away the equivalent of one month’s living expenses and aim at growing it to six month’s worth of expenses. Think about it, if you suddenly lose your main source of income, you’ll have money to tide you over and supplement unemployment benefits while you look for a new job.

Building credit is also a good way to shock-proof your budget. Good credit allows you to get decent interest rates on loans and can boost your budget by letting you skip utility deposits and by enabling you to get cheaper insurance rates.

How to Build an Emergency Fund

- Set a monthly savings goal

- Open a high-yield savings account in a secure institution that offers a competitive interest rate. On payday, automatically transfer funds to your savings account. Grow your emergency savings balance

- Keep your change and store it safely in jars – move the money when the jars fill up. If you prefer cashless transactions, set up a mobile savings app to receive automatic transfers from transactions that you make. We recommend Qapital, Acorns, and Digit

- If you have some money at the end of the month, move it from your checking account and into your emergency fund

- Get additional income. Get a second job, work overtime, or sell unused items to raise money for your fund

- Boost your emergency stash by setting up automatic deposits of your tax refund

- Assess and adjust the frequency and amount of contributions. Major life events can cause you to dip into your existing savings fund. So, check on your funds every so often to see where you are

Reduce Debt

Paying down “toxic” high-interest debt is a crucial step in financial planning. Avoid paying double or triple the amount you borrowed, by paying down the high-interest balances on debt such as title loans, credit card balances, payday loans, and rent-to-own payments.

It is not advisable to take up a debt consolidation loan as most of them are shams and end up making you pay more interest for a prolonged period.

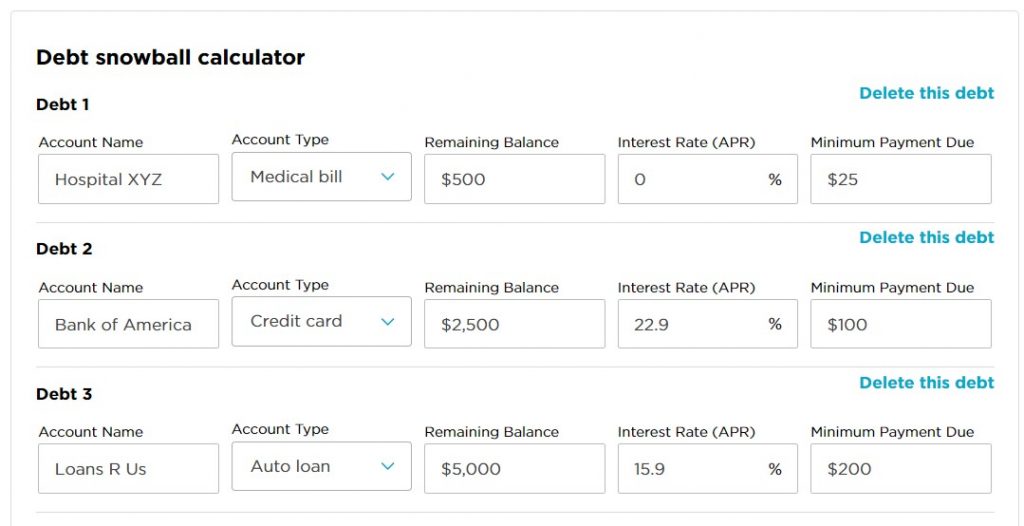

If you find yourself struggling with revolving debt, consider implementing a debt repayment strategy.

Image via Dave Ramsey

Debt Repayment Strategy

Utilize the common strategies below to boost your payoff speed:

Debt Snowball.

First, pay off the smallest debt and then pay off the next small debt, by rolling/bringing forward the amount you had been paying on the now “paid off debt,” to the new debt. Envision the debt repayment process – picture a snowball rolling down a hill.

Be sure to pay minimums on any other debt.

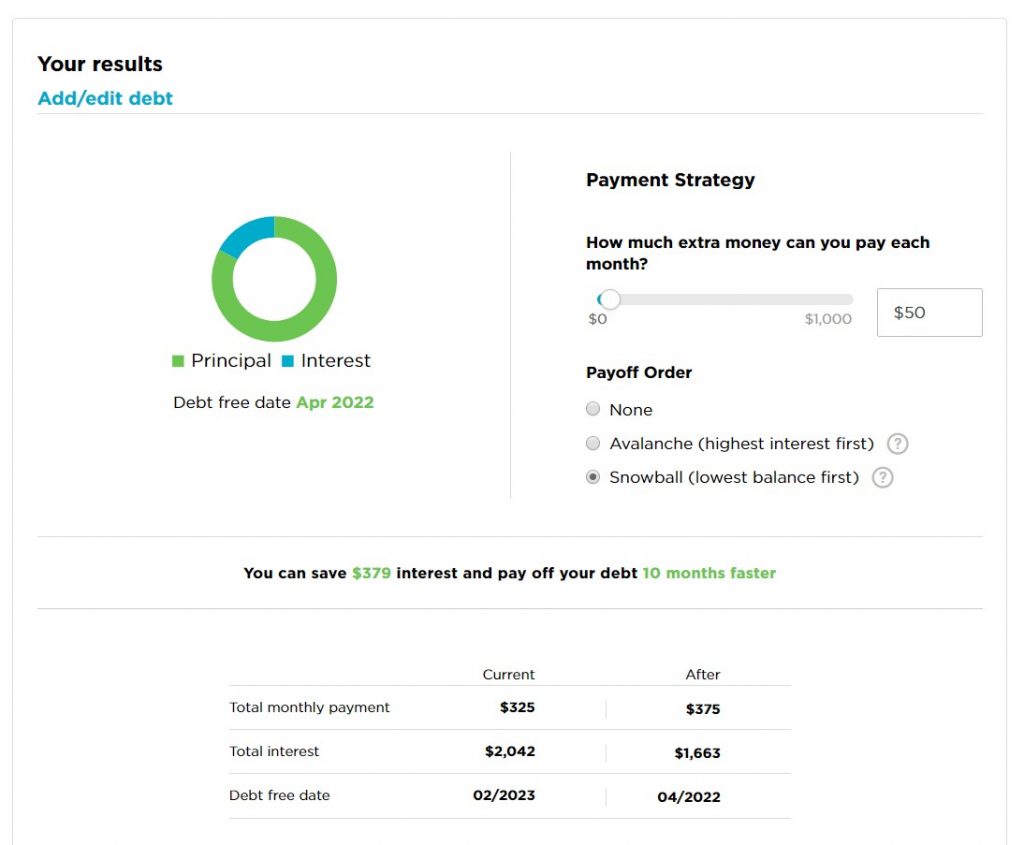

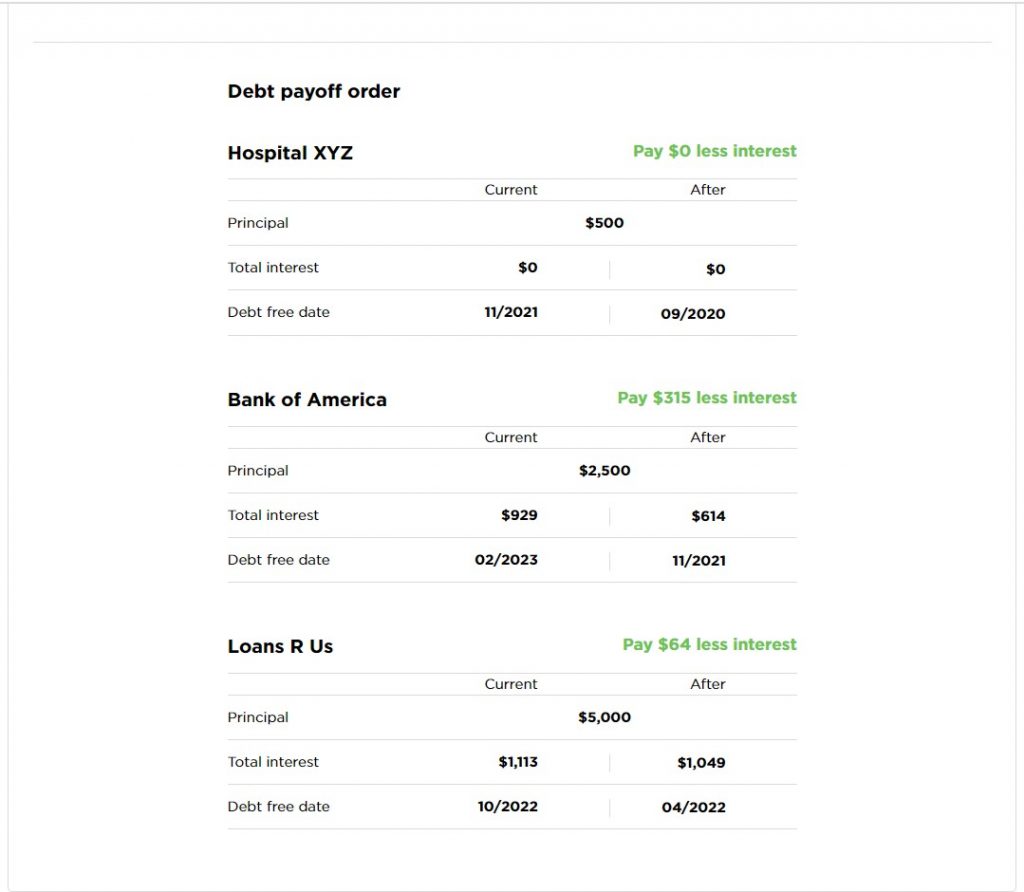

In a debt snowball example, you’ll begin by paying off hospital debt which has a balance of $500 at a 0% interest rate, and with a minimum monthly payment of $25. You also have a $2,500 credit card balance at 22.9% interest and a loan of $5,000 at 15.9% interest. Assume that you have an extra $50 per month to go toward debt repayment.

Image: Total Personal Debt

Image: Debt Snowball Payment Strategy

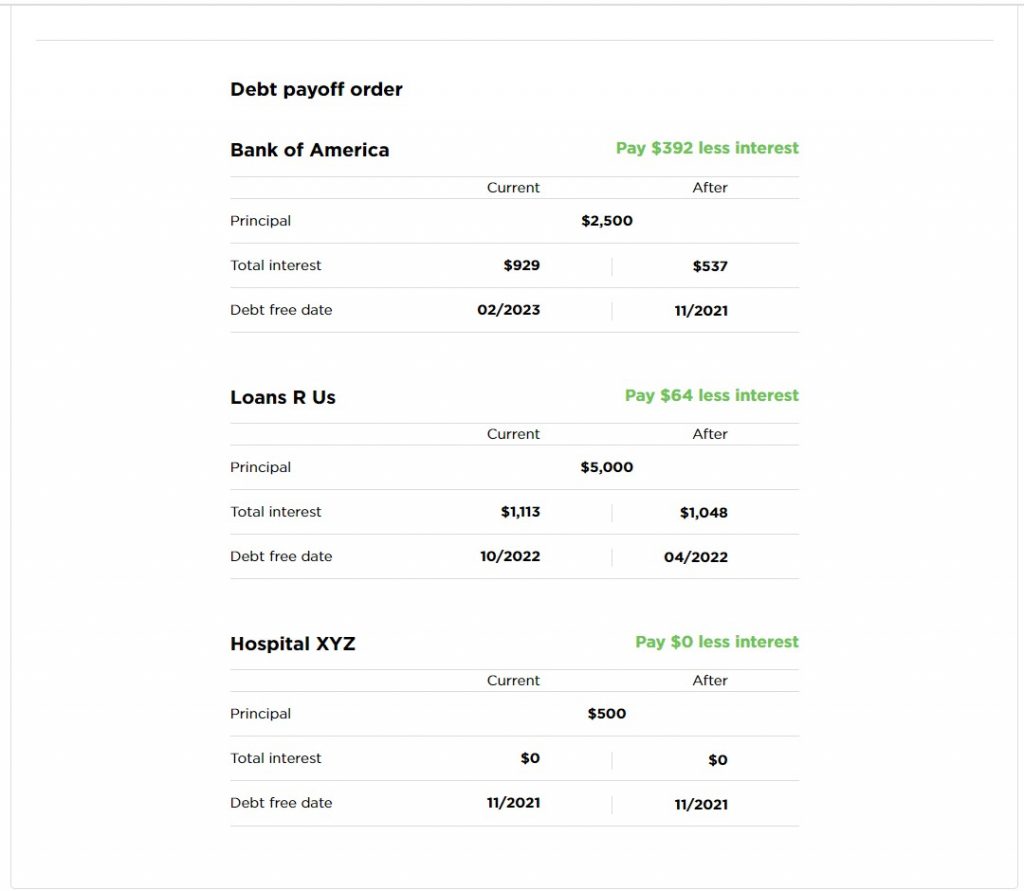

Image: Debt Snowball Payoff Order

If you need to pay off several debts, a front-loaded system that provides rewards can help keep you on track. This is the premise of the “snowball debt repayment” method.

The satisfaction of eliminating your debts, one by one, keep you engaged. Debt snowball differs from the debt avalanche strategy because it could potentially take much longer to get the first debt paid off.

You’re an ideal debt snowball candidate if short-term victories inspire you.

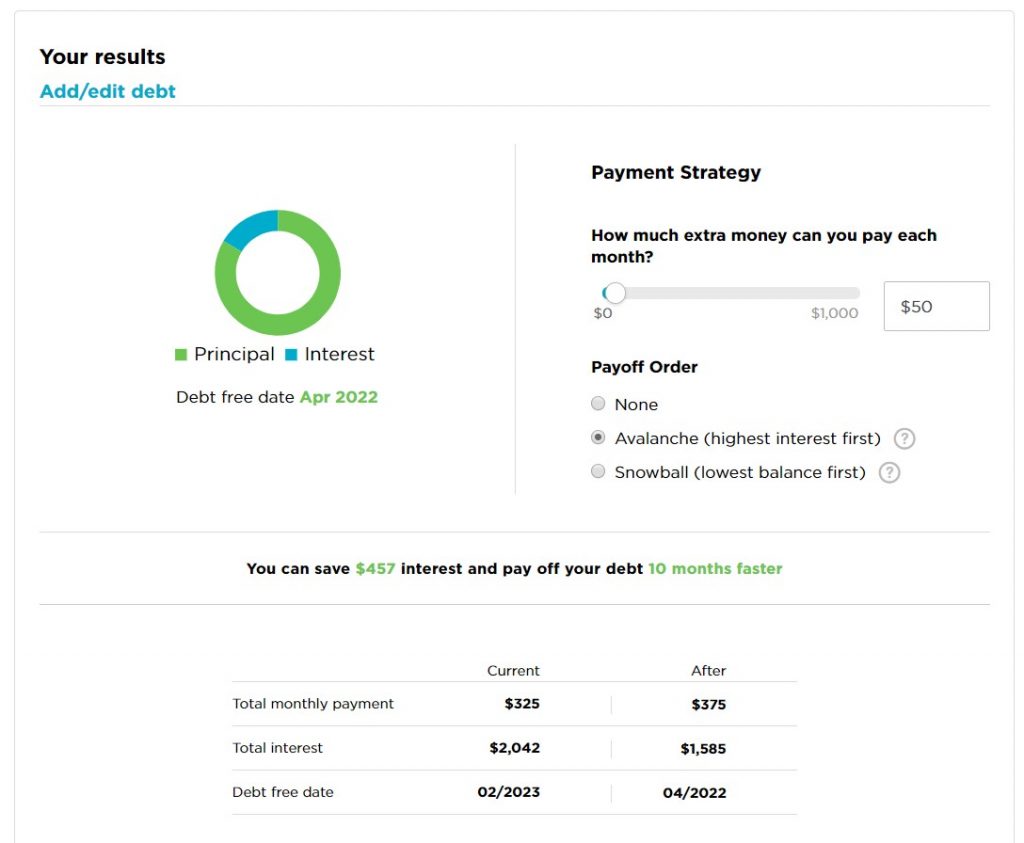

Debt Avalanche

First, pay off the debt that has the highest interest rate, then move to the next highest, and so on. In the long run, this strategy will save you time and money.

Be sure to pay minimums on any other debt.

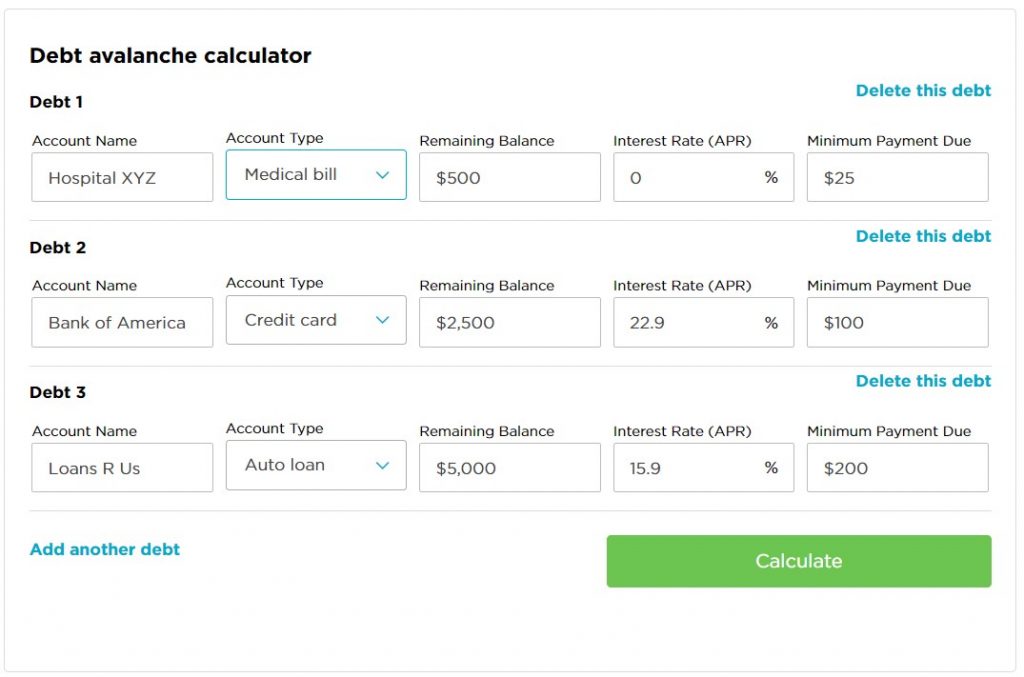

For example, let’s assume that you’ve got a hospital bill of $500. The hospital allows you to pay on it interest-free. You also have a $2,500 credit card balance at 22.9% interest and a loan of $5,000 at 15.9% interest.

The $2,500 credit card balance carries the highest interest rate and will, therefore, become your top priority. Any extra money above your total minimums will go toward paying off that credit card debt. Let’s assume this amount to be $50.

Every month, $50 will go toward paying off the card, until it is paid off. After that, you’ll “carry forward” the credit cards debt minimum, add it to the $50 and begin paying off the $5,000 loan.

Image: Total Personal Debt

Image: Debt Avalanche Payment Strategy

Image: Debt Avalanche Payoff Order

Continue knocking off debts and pushing forward their minimums until debts are paid off. If any promotional rates on credit cards end, reorder your debts to keep you focused on the one with the highest rate.

If you tend to be patient and analytical, the debt avalanche method may appeal to you.

Debt Management Plan.

If you are overwhelmed by bills and a mountain of credit card debt, seek help from a nonprofit credit counseling agency. They’ll help you set up a debt management plan that’ll reduce your interest rates and get you on a repayment plan

Debt Tips to Keep you on Track

- Know your budget. Make the most of every dollar at your disposal, to pay off debt

- Lower your bills. By reducing your, for instance, utility bills, you will have more cash available to pay off your debt

- Earn more money. Get an online side hustle with flexible hours, work overtime at your current place of employment and increase your earning potential

- Get debt relief if you do not make any significant progress in paying off debt

Invest and Grow Your Income and Savings

Investing is neither the preserve of the wealthy, nor for those established in their career and family life – anyone can invest and grow wealth.

Think of investments in simple terms, for example, putting money in a 401(k), or opening a robo-advisor account. Investing in the stock market is the preferred way for Americans to build wealth and save for retirement. Getting started, however, can feel daunting. It doesn’t have to be.

Figure out how to invest money by considering a few key factors:

- Urgency – when will you need the money

- – whether you want to invest money on your own or hire someone to do it for you

- The type of investment account to use – taxable brokerage account, IRA, 401(k), or education investment account

- The assets that match your risk tolerance – bonds, stocks, reals estate, mutual funds, etc.

Decide if You Need Help

Most investors begin by researching investment options on their own. They set goals, select investment vehicles and open various accounts. If the DIY route is not your “cuppa tea,” no worries.

Many investors prefer to hire financial managers to do the hard work and invest their money for them. While hiring investment professionals used to be pricey, nowadays it’s quite affordable, thanks to the advent of virtual financial services, e.g., robo-advisors – automated portfolio management services

Give Your Money a Goal, Set a Deadline

Investing money begins when you determine your investing goals and associated deadlines.

- Long-term goals

Retirement is often the universal goal. However, you may have additional goals as well: Do you need college tuition or a down payment on a house? Do you want to go on a luxury anniversary trip in 10 years or purchase a dream vacation home?

- Short-term goals

This includes next years vacation, a condo you want to purchase next year, your Christmas piggy bank or an emergency fund

Pick an Investment Account

Here’s a list of popular investing accounts. With the exception of a 401(k) plan, which is offered by an employer, you can open these accounts at an online broker:

If investing for retirement:

- 401(k)

- Traditional or Roth IRA

If investing for another goal:

- Taxable account.

Sometimes referred to as nonretirement accounts, these flexible investment accounts are not used for any one purpose. Unlike retirement accounts, you can withdraw money from the account at any time and there aren’t any rules on contribution amounts. These accounts do not have specific tax advantages. In the instance that you max out in the aforementioned options, you can continue saving for retirement in a taxable account. They are, therefore, useful savings accounts

- College Savings Accounts.

When saving for college, these accounts offer tax perks – just like retirement accounts. A Coverdell education savings account and 529 account are commonly used to save money for college

Financial plans typically use a variety of tools to invest for college, a house, or retirement:

- Employer-sponsored retirement plans.

With a 401(k), 403(b) or similar plan, you can expand your contributions up to the $19,000 yearly IRS limit. If aged 50 and above, the limit increases to $25,000

- Traditional or Roth IRA.

These investment accounts which have tax advantages can build your retirement savings by up to $6,000 a year – $7,000 if over 50

- 529 College Savings Plans.

These state-sponsored plans have tax-free investment growth and withdrawals for education expenses

Safeguard and Grow Financial Well-being

Build a moat to protect yourself and your family from financial setbacks. As your wealth increases, improve your financial moat by:

- Investing in new opportunities, e.g., by becoming a venture capitalist

- Increasing contributions to retirement accounts

- Padding your emergency fund until you get a good amount of money, enough to cover essential living expenses for three to six months

- Use insurance to protect yourself, assets and investments, just in case. Life insurance will protect your loved ones, who depend on your income. Term life insurance that covers 10 – 30-year periods is a good fit

Adjust Your Financial Plan

As you go along the investment journey, adjust your financial plan. A financial plan shouldn’t be static, it is a useful tool that tracks your progress and should, therefore, evolve according to life’s changes.