Business Succession Planning!

Imagine putting in 80 hour weeks of blood, sweat, and tears for years and years…only to watch your business fold. What?

So. Fun fact! Up to 95% of small Businesses do not survive past the 3rd generation. That means, out of the entire network of millions of small businesses that make up most of our economy and job sources, only about 5% will be around to create generational wealth for the grandchildren and great grandchildren of the current owners. Decide right now that you will be among that 5%

In order to ensure that your business doesn’t pass on when you do, you are definitely going to need a business succession plan.

What is a Business succession plan?

I’m glad you asked. Buusiness succession is defined as “The transfer of a business that results from the owner’s wish to retire or to leave the business for some other reason. The succession can involve a transfer to members of the family, employees, or external buyers. Successful succession results in a continuation of the business, at least in the short term” (Martin et al., 2002, p. 6; SBS, 2004, p. 7).

Succession Planning refers to the process of finding, evaluating, and developing the best talent and employees for key positions in your business. Whether it’s making your best employee into a manager or mentoring your most qualified child to step into your shoes as owner in 10 years.

And if you never heard of Business succession planning, then you might be thinking to yourself, why would I need a drawn out researched plan? After all, I’ve got a will to leave my business to my kids…

And you would then be extremely surprised once you finished reading this article.

How many business owners have a succession plan?

Well, according to that 95% statistic…not nearly enough of them. To be clear, the studies show that 95% of those businesses fail in succession, plan or not. But upon further research, the main reason cited for their failure…is a lack of a business succession plan. So you do the math. Apparently, there is a whole majority of people out here thinking that business succession is a smooth and painless process.

And just so you know…succession is going to happen, having a plan means that it will happen the way you want, but it’s going to happen anyway.

What are the causes of business succession?

Death. Retirement. Disability. Illness or Incarceration. The main ones! Several of these can happen at any time, for any reason. And all of these require a business succession plan to smooth the process. Without a succession plan, death is the only one among that group that allows you not to have to watch what you worked for go swirling down the drain.

How does every succession happen?

Like I said…succession happens. Whether you plan for it or not. I’ve listed all the ways below. The last one is what I want you to avoid if at all possible.

Family succession

Management buy ins and outs

Franchising and licensing

Joint ventures

Public listings on stock exchanges

Mergers

Benevolent successions/disposals

Divestment and contracting out

Rescues

Cessation of trading, liquidation

Why is succession planning important for small business?

Let’s say you own a successful business and then you die. My condolences. You live in a state that only allows your spouse to own shares in your company for a limited amount of time (60 or 90 days). Upon your death, your business goes through a business valuation process with the IRS. (They are going to get the highest numbers in order to tax the bone marrow out of your spouse). Maybe your life insurance isn’t enough. What does your spouse do?

What if you have a partner and they get a divorce? Let’s say, all the value is in the business and now the partner’s ex wants their portion in cash. Now the company has to be split up. What if the business can’t survive such a split?

Maybe you were able to run your business successfully because of your sound financial practices and good sense. And you want your niece to run your company but you have an idiot son whom you must provide for financially. Without a succession plan, you can leave the company to the idiot son in your will, and have your investors and creditors pull their support or call in their loans.. The son most likely will run the business into the ground. And the niece will have no power or say.

Alternatively, you can leave the company to your brilliant niece. But what if she decides the son doesn’t deserve any financial help and instead cuts him out entirely. You can leave it to them equally and have them destroy the company with infighting. This much is clear, a will isn’t going to be enough. Not just because a will doesn’t cover everything necessary, but also because death isn’t the only reason you would step down from ownership.

What are the benefits of succession planning?

Ensures piece of mind, knowing you’ve set your business up for success into the future. That’s the most important benefit. Making sure that your life’s work will be sustainable beyond yourself.

But proper succession planning also has the noted benefit of motivating employees. The time spent developing employees for key positions isn’t just a benefit for your company, but for the employee as well. Studies show that people who see career development in their professions are more productive and happier. It promotes loyalty.

You are maintaining your brand as well. Whatever values you instill in your successor and top positions, are values that are more likely to be passed on and on. By doing this, you are making the positions more than a job because you’ve given them ethical and moral context and meaning.

What is the process of succession planning

The Process can be broken down into 6 key steps. Keep in mind, the depth of the actions taken in these steps will vary from business to business. Also varying depending on which positions and who you are putting in these positions.

Remember that it takes anywhere from weeks to years to develop a good succession plan. And the average amount of time for a person to settle into a position and become optimally productive is a year to 18 months.

Step 1 Identify

Step 2 Evaluate

Step 3 Assess

Step 4 Develop

Step 5 Act

Step 6 Reevaluate

Developing the plan

Identify

Remember that succession plans have many working parts.

You need to identify what positions, are critical in your business. Which positions, especially ownership, that are key in the businesses operations, marketing, and its overall success. What are the positions that must always be filled or the company may fall? What positions are key to the companies future?

Evaluate

Now you have to go through those positions and evaluate them. What practices, values, talents, requirements, education are necessary for each position. What skills and qualifications do they require? What are the expectations of and the capabilities of the people filling those roles.

Do they need to be bilingual, be a certified accountant, or have a marketing degree? Do they need to be a great public speaker, or be physically fit(maybe you own a gym or a health supplement business)?

Assess

Employee and successor Performance Appraisals!

Now you need to assess the people you have in mind for those roles. How interested are they in stepping into those positions? Do they have the skills, capabilities, or mentality to perform the way they would be needed to? What are the skills they lack? If they are lacking, is it worth it and financially feasible to get them the proper training?

Develop

Develop the plan to incorporate the necessary training and mentorship for the individuals you want for those positions. Create your hiring requirement lists and training guides for future employees.

Act

A good plan is just an idea until put into practice. So Act!

Yes, this means hiring or firing. But that isn’t the full scope. You must start training the employees according to the plan. And if you’ve identified a successor, this means mentoring, training, and guiding them to be able to fill your shoes adequately when the time comes.

Reevaluate

Do performance appraisals every quarter or 6 months. Be consistent. You need to know if you’ve missed something. Maybe you want your top managers to learn Chinese instead of Spanish. Maybe instead of leaving the entire business to your children, you’ve decided to include a top performing loyal employee as part of their partnership. Be adaptive and be thinking about backup plans. This is your legacy!

Problems developing a succession plan

There are a huge variety of issues that can arise when trying to develop and implement a business succession plan. The least of which is the fact that most business owners don’t want to take the time away from actual business to do it. There are other problems that can hurt you as well.

Choosing a successor

Choosing a successor can be arguably the most important part of your business succession plan. Whomever you choose, can either exponentially increase the value of your business, or drive it into the ground.

Pros and Cons of family

Most small business owners want to leave their businesses to family members. And indeed, studies show that there are certain advantages to doing so.

The time spent mentoring and nurturing family members and instilling entrepreneurial values and drive is a valuable asset to the business. With family, the business owner tends to spend more time developing the successors education. Often providing them with years of experience of working in the company at every level.

Successful successions tend to occur more often within families that have positive family relationships. Those relationships usually have trust, and lack conflict, rivalry, and resentment.

On the flip side, family successors may dislike the idea of taking over, or have limited emotional control, or have family jealousy and sibling rivalry. Some problems also include a lack of interpersonal relationships with other employees or a sense of entitlement.

Choosing non-family as a successor

Non family member successors have their pros and cons as well. There is usually not as much of a time and financial investment as many non-family successors brought many of their skills and talents with them when they were hired. Having more to prove, they are usually required to be optimally productive and don’t come with the familial emotional obligations.

But it is harder to woo adequate successors to small businesses if they aren’t family members

gender bias

It has to be noted that there still remains a gender bias when choosing successors, even today. The majority of business owners still desire to hand their businesses off to their sons instead of daughters. Additionally, women suffer in multiple ways from the successor discrimination. If they are chosen as a successor, they receive less feedback, support, training, and preparation. Because of this, they tend to lack confidence in their abilities to do the job and are not taken as seriously by others within their company and industry.

Business Planning and Objectives

Besides the actual people involved in succession planning, there are the practical applications as well. First, is the company viable enough to be passed on to future generations, or should it be sold instead? Some companies cannot withstand the financial or legal transfers of ownership and must be dissolved or liquidated to avoid destruction. What are the future plans for the company? Will it remain in it’s current shape, or would it benefit from a merger or franchisement? Inevitably, all these factors are important when developing a business succession plan.

Legal Issues

Every business has it’s legal requirements for owner transfer. These change depending on what type of business entity it is. Sometimes, it’s just simple paperwork, other times, it can be a headache depending on what type of legislation is in place. There may be laws in place depending on the industry, state, and type of business entity (sole-proprietorship, etc).

Be aware and stay informed.

Financial Issues

While every stage in business succession planning is important, you need to double check with the financial side. Financial issues arising through succession can and usually do determine whether your succession is a success or failure all by itself. Business valuation, especially undergone during succession, is a big key. The value of the business is used to determine what the business is worth, how much it can be leveraged for, or sold for, as well as what taxes are owed.

Even the process of business succession planning is costly.

Some businesses even seek financing to pay for the cost of the transfer of ownership upon succession.

Tax issues

Be aware of the tax issues that can arise upon succession.

Depending on whether you sell your business or pass it on as an inheritance, there are taxes that govern that action.

The Capital gains tax applies to the business valuation (there’s that word again). A capital gains tax is levied upon the sale of that results in a profit. So you are taxed on the difference between what the business sold for and what it cost to acquire (basis).

And then there’s the inheritance tax. That tax is paid by the successor. Often times, when improper business succession planning occurs (or no planning), coupled with a lack of estate planning, businesses are destroyed through succession because of taxes.

Additionally, there are still 6 states that have a separate inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

And all of these taxes are in addition to whatever new income tax bracket the successor steps into on the federal and state levels. Do your due diligence.

...And in conclusion

Your business is your legacy. Oftentimes, your life’s work. Don’t let a lack of preparation destroy what it took you a lifetime to build and destroy whatever generationalwealth you thought you were creating for the future.

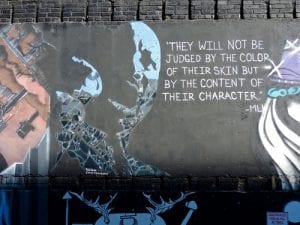

Closing the Gap: Uniting for Equitable Black Generational Wealth

Let’s stand up for fairness, rewrite the rules, and create a world where everyone has a real shot at success.

Bridging the Wealth Gap: Efforts Towards Equitable Solutions

Introduction: Bridging the Divide – Understanding the Wealth Gap A Persistent Disparity in Wealth: Unveiling the Divide The landscape of the United States is characterized

The 4 Essential Tools You NEED for Audiobook Narration

It doesn’t have to be expensive. No need for fancy bells and whistles! It only needs to work.

PRO-TRUMP ASSAULT ON CAPITOL AND WHITE PRIVILEGE

Introduction Police Handling of Pro-Trump Assault on Capitol and Black Racial Justice Protests The Effects of White privilege On American Society White Privilege Before Assault

COVID VACCINE AND BLACK PEOPLE: Why Blacks Are Skeptical

Introduction The Reasons For The Black People Fears Facts About COVID-19 Vaccines The Way Forward Introduction The effects of the out break of covid-19 is

Socio Economic Equality: Understanding The American Society

Introduction Understanding Socio Economic Status (SES) Effects of Socio Economic Status What Is Socio Economic Factors? Introduction The economic realities of the pandemic are ushering