Table of contents

- Ladies…Grab your shovels!

- What is Gold Digging?

- Why was Gold Digging a thing?

- Guide to building wealth by black womeni

- What changed?

- Gold Digging and women’s right?

- But why black women?

- What black women should know about building wealth

- Ways black women can escape debt bondage

- How do we get it back?

Ladies…Grab your shovels!

It’s time to bring back gold-digging!

Like mom said countless times, “Love don’t make no turds!” It was unromantic, and it was coarse, but it was true. Love don’t make no turds; nor does it pay bills, nor create wealth. Love, alone, also won’t keep a marriage together. Yet, many of us refuse to acknowledge that love should take a backseat when searching for a potential mate.

Bring back the transactional value that created and sustained most of the marriages that existed prior to the 18th century. But why did we lose it, where did it go, and why is it the only viable option for black women in 2019 and beyond?

What Is Gold-Digging?

In my research, the answer to that question depends on who you ask. In general, it is a woman (or man) who seeks out romantic engagement for the sole purpose of financial gain. But black women can also be considered gold-digging by only dating men who have successful means of employment. And especially in the black community, it can be considered gold-digging to expect even the smallest amount of financial assistance or even a meal from a decent restaurant.

For the purposes of this article, we will use gold-digging as the term to describe finding a mate with the means to secure generational wealth for any future generations the two may create.

To be clear, that may not mean millions in the bank. It may mean 100 acres of farmland, a passing grade from the BAR exam, a recent ownership or procurement of a franchise store, or even a solid business plan. Whatever the means, it must be capable of providing a better future for your legacy than you can now. Even if you’ve already secured the bag yourself.

Why Was Gold-Digging a Thing?

Marriage didn’t start out about love. Marriage was about alliances and consolidating assets and power. It was a lifetime contract used to amass wealth. It wasn’t all that long ago when a man couldn’t marry a woman without providing physical proof that she would be taken care of financially, whether it was in the form of a home, land, cattle, or currency. Neither would a man, with these assets, consider marrying a woman who didn’t come with a dowry.

Guide to building wealth by black women

Never too late to start

You need to understand that it’s never too late to start building wealth. First, you have to study yourself very well, from there you will understand how much it costs to be you. And from your self analysis you find out you spend more than you make. Then you have to go back and look at your daily habits and create a new budget. At least, you have to be saving 10% or more of your income that you won’t touch, and it’s very crucial to have at least six months of your expenses saved up in case you happen to lose your job.

Also, the first day you start your new job, take out this max (in 2019, $20,000 annually, and $26,000 for 50 years and over) for your retirement based account. Taking out this maximum amount, could put you into a lower tax bracket, which could save you much more money.

Probably you’re your own boss, put aside 30% or more of what you earn away for taxes. You could speak to a financial expert about setting up an SEP IRA for you. A Simplified Employee Pension Individual Retirement Account will allow you, or anyone else with freelance income to open an account and make tax-deductible contributions. Like a typical traditional IRA, the money in a SEP IRA is not taxed until withdrawal and business owners may contribute up to 25% of income.

Educate your children about budgeting

There’s need to look at the conversations that take place at home about money and things we are teaching our kids. For instance: giving $5 as weekly allowance to a child as young as five years old might build their understanding about money. 1/3 of that money will go to a savings account, 1/3 for philanthropy, and 1/3 will go for spending. And no candy!

Taking a child into the bank, they will have the understand that this is an institution. An ATM won’t leave that impression. Explain to them that when you buy something with a credit card today, in 30 days a bill will be at your doorstep, and when you don’t pay on time you will for late fees. Also you may give them things to budget. For instance: give them the amount of money you budgeted for their back to school clothes and allow them make the list based on the amount you have to spend.

Invest in the future of your child

When you give birth to your child, every birthday, Christmas or any holiday your child gets money, establish a 529 College Fund account when at least 50% of it should be saved. When you own significant assets or your child is with special needs, establishing a trust with the support of a well qualified estate attorney will be a powerful way to foster the longevity of assets. As well as protect the welfare of your children throughout their lifetime.

Multiple streams of income and investments

Let’s use this analogy, probably you’re in an elevator that has only three cables and one of them happens to break, the other two will certainly hold it up. That the same thing with multiple streams of income. When one stream doesn’t work, the others will help balance the equation. It’s also the tactics behind diversifying your investments between these three asset classes:

- Stocks

- Bonds

- Cash

Stocks are the equity that you purchase when a company is selling their shares. You mqy buy one, two, or many.

Bonds are.well considered fixed income. For example, a company has it that if you give me $1,000, I will pay you back 4% interest for that year. At the end of the year, I will be able to give you back your $1,000 and you will still receive $40 for allowing us use your money.

Cash is the phyical money you are able to put in a bank that they pay you interest on. Interest rates for savings accounts are very low now. But Save Anyway! You will continue to earn because of the accumulative effect of interest. Meaning interest on top of interest earned when you didn’t withdraw your money.

Property investment

Often people ask if buying a house is still a wonderful investment? YES! Because it will allow you to build equity for yourself as a black woman. You will build up equity in a house as you keep paying down your mortgage. The less you owe on the property, the more equity you will have. When you are able to have equity in your home, you might “borrow” money against it, that’s known as refinancing your home. The one of the danger is mortgaging your home to its market value. This will make you not to have equity in your home. Property is one of the major assets that you can passed from generation to generation.

Deeds and setting up a will

A deed and a will, the two are very important. A deed will establish ownership of a piece of property. When you and your partner purchase a house, it’s very important that both names should be on the deed. To avoid any issue when the property is transferred to someone else. Due to the complexity of federal and state laws, we do recommend that you should work with a qualified estate attorney. To be able to draft your will to reduce the possibility of family conflict. Be specific in what you want each child to have, even children you intended not to leave anything, so that your will will never be contested. For instance: each child will be mentioned by name and leave something, even if the amount is $1. So it will be clear that the child was not forgotten, and he or she won’t be able to contest your will.

What Changed?

We could talk about post French revolutionary idealism and the influx of poverty that drove women into the work force that led to the destabilization of gold digging. The idea that love was a factor only became widespread after that. The concept of marrying into wealth never left, but over time became demonized and a cause for shame and suspicion.

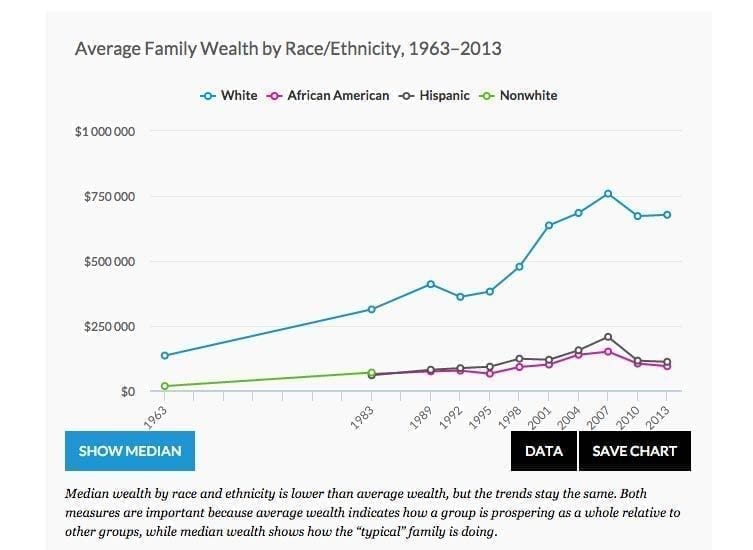

Specifically, in the black community, where black people on average have only half the earning power and only 5% of the wealth. These numbers are abysmal but speak to the black condition in America. Without gold-digging, the next generation doesn’t have much of a chance of doing better either.

Gold-Digging and Women’s Rights?

Of course, there will be those who argue that if gold digging makes a triumphant return, women’s rights will be set back. Consider this, why can’t we have both? I’m not advocating that you marry and divorce, or marry and arrange for an untimely death. I’m saying, if you value your worth, as a woman, as a wife, as a mother, then prove it. Accepting the bare minimum needs to become a thing of the past.

There is no need to settle for the bare minimum. Imagine the call for black men to better their own circumstances if they know that their entire procreational future relied on it. If you know better, you will do better.

But Why Black Women?

Fast forward to 2019. Black women are the least married, having most of their children out of wedlock. Many of them refusing to seek child support, despite needing it the most. Having been shamed for generations for “allowing the white man to get in their business”, child support court has continued to be a demonized resource for black women.

The USDA released a report that says that raising a child from infancy to 17 years of age is over $230,000. You can read more here. That’s a little over $1100 a month. Most of the noncustodial parents who pay child support, complain about paying considerably less. That $230,000 doesn’t include private schools, college tuition, or tutors. It only includes the amount needed to raise a child well enough to continue in the cycle of lower to middle class struggles.

The point is, it’s time to stop procreating with men who don’t have the wealth to care for the children they help create. We can negate all of that by following proper reproductive planning. So why black women? Because we need it. Black children make up the majority of foster children. The same black children make up the least educated. Black children are the ones being short-changed. And it is our responsibility to create a future for these children.

We claim that we want to rebuild black wealth but how can we expect those results if we aren’t ready to set aside momentary lust or infatuation for wealth? How can we raise our daughters and sons to continue in a wealth building legacy if we don’t bring back higher standards?

What black women should know about building wealth

First, let’s discuss about three basics steps to obtaining wealth by black women:

Financial literacy and financial planning

No matter the millions in the bank, as a trust beneficiary you are expected to submit your budget and know your assets and liabilities. You need to have a plan.

Investing

Every trust that you see, have marketable securities and other investments. Additionally, trusts that included a business were basically the larger trusts. Investing is one way you ensure that your money is growing.

Estate planning

Understand that generational wealth and trusts can’t be possible without an estate plan. Money can be transferred successfully to one generation, but rarely does this money continue on to the second or even the third generation.

Empowering a black woman through financial literacy basically results in improved financial health and well-being for her entire family. It also remove the mindset from people that they get into marriage because of the financial assistance they will get.

Here is what you can do to stop this issue of gold digging cycle.

Financial planning

Well, black women need to be confident financially. We have to understand that we are capable of handling any financial situation that comes our way. We can’t afford to live feeling guilty and condemned by our past mistakes. Instead, we need to act with confidence. That will help us make the right decisions for our lives and for our children.

Now, how will you build this financial confidence? First, start by taking a self-inventory to understand your money strengths and weaknesses:

Write down your goals and your why

Why you need to achieve something is crucial when you’re trying to decide how to prioritize your own goals. After you have set your goals, never listen to the naysayers or even your negative self-talk.

Figure out how much money you have, how much you earn, and where it’s going into

You have to understand if the money is going to your stated goals

Learn how to fix any issues you see

With your self-inventory result, it will give you actionable insight on what you need to do in order to achieve this financial confidence and self-sufficiency. There’s need for you to stop thinking about what you’ve been through and the mistakes you’ve made, and what you don’t know or even understand. Just forgive yourself and move ahead so you can be able to get what you desire.

Self-sufficiency doesn’t not in any way mean you shouldn’t ask for help. It means you need to have some idea of what you need to do. That’s saving, investing, taxes, retirement, estate planning and what is in your best interest based on your goals.

Investing

You should set out to learn the basics of investing. Read books that you lay hands on, ask questions, and start having financial conversations. More importantly, take action to implement what you’re reading. You need to study your investment options and create a retirement investment plan. You have to willing spirit to learn what you are doing. No one really care about you and your success the way you care about.

Estate planning

You need to understand that it isn’t enough to build wealth through saving and investing, you need to also protect your wealth. Dying without an estate plan in place for your children will certainly turn your family’s mourning time into a frenzy of fighting.

Estate planning is much deeper than who gets your money after you are gone. At some point, you will certainly need help. An accident, old age, declining health state, having a child, or being out of the country would trigger the need for an estate plan when you are alive but unable to make any financial decisions for yourself. When you have done your estate planning well, your plan will spring into action and your designated representative will be able to act on your behalf immediately.

When your goal during life was not to be taken advantage of, never allow it happen to you in death. Many families and charities end up not seeing the money they were promised when there is no estate plan in place.

Note this

When building your own estate plan, do consider who is capable of managing your money and where your money will go. If you trust the people you want to leave this money to can be able to manage a lump sum, then write your own will or have a full estate plan drafted by your attorney. Do you need your money to go to a minor, a pet, a friend, or you have a business to protect? Then, there’s a need to consider having a trust drafted. And do remember to always update your estate planning documents regularly.

Estate planning is meant for everyone, and your plan should be updated annually at minimum. This will ensure that you are effectively controlling and protecting your legacy very well.

Ways black women can escape debt bondage

Become financially literate.

Financial freedom is not entirely based on the ability to generate more income; it actually means understanding how money works. What do you understand about investment options? Are you quite familiar with your debt to income ratio? Do you really have a working knowledge of credit and how you can build your credit score? Black women have to take time to understand the dimensions of money. Without a solid understanding of financial basics, you will be at a grave disadvantage when it comes to being able to create leverage in the marketplace. Money is what drives decisions. Without knowing how you can generate and transfer wealth, you will continue to pass down habits and behaviors that will certainly promote destitution.

Have more than one stream of income.

It has been proved several times that millionaires have seven consistent streams of income. However, a significant number of Black households are still attempting to sustain themselves with just one source of income. This will not only make it nearly impossible to survive but also dismisses any opportunity a family might have at financial prosperity. It is important that Black families start the process of creating more streams of income, together with residual income.

Investing in life insurance combined with retirement plan.

Our financial portfolios are really nonexistent. There’s a need to teach our girls the importance of preparing for the future financially. What arrangements have have you made to support your family in death? The problem is many of us do not have adequate life insurance, and there are usually no plans for retirement outside of our 401(k) contributions. We need to understand the importance of a versatile financial portfolio.

Think beyond your prosperity

Comparing to others, understand that we are the most divided race. If you could wrap your mind around being self-sustaining and centered on group economics. You could start to see your money work for you. Being self-sufficient will allow you to purchase land, own homes, plan your retirement properly, even push for educated financial decisions and minimize debt too.

Grow from your small businesses to enterprises

Historically, Blacks are known to have faced many obstacles in their pursuit of labor independence. At the turn of the last century, state and local policies placed many unrealistic restraints on Black business owners, making it more challenging for them to prevail. Today, our own challenges are quite different. Though we are seeing more Black businesses in circulation, just that many do not fully blossom into large-scale enterprises. When it comes to issue of Black entrepreneurship, it is imperative you harvest the knowledge and technical knowhow that will assist you in growing your business. Spending more of our money in our community and supporting our Black-owned businesses is a better way to support the growth of small Black-owned businesses.

How Do We Get It Back?

It starts with us. We are the gatekeepers, the creators. We alone have the power and according to the millions of men who father the children in single parent homes and foster care, the responsibility. That means making the hard choice, setting the standard, and sticking to it. There are of course, things you may need to do prior to seeking such a mate

Obviously, personal hygiene, body image, and affecting the right attitude will play a part. But the rewards will far outweigh the price you pay for the security that comes with it. The role of personal growth can only increase your odds of finding the proper mate. Yes, it’s possible to find a husband in your city, but unless you live in a community of millionaires and billionaires, it’s unlikely you will find what you need there. If you seek a doctor, perhaps you need to be in the medical profession yourself. And you seek a lawyer, the legal profession, etc. If you need more precise info, check out the book The Art of Gold Digging.

Many of us have grown up, raised by mothers and fathers who told us that we deserved the best, but whose poor planning or unfortunate circumstances prevented them from giving it to us. We know life is short and incredibly brutal. Happiness and purpose is most often determined by class and income. Perhaps it’s time to try something new…or rather, something old.

So tell me, do you have a financial standard for your potential mate? Make a plan.

“We know life is short and incredibly brutal. Happiness and purpose is most often determined by class and income. Perhaps it’s time to try something new…or rather, something old.”

I love that.