Table of contents

- Who is AOC really?

- The beginning of the controversy

- The facts

- Impact of the living wage on Americans

- Taxing the rich is fine

- And finally

Who is AOC really?

Alexandria Ocasio-Cortez, born on October 13, 1989, well known by her initials AOC. She is an American politician serving as the United States Representative for New York’s 14th congressional district since the year 2019. The district includes the following:

- Eastern part of the Bronx

- Some portions of Queens Rikers Island in New York City

She is a member of the Democratic Party. AOC became a national figure when she won the Democratic Party’s primary election for New York’s 14th congressional district on 26 June, 2018. She defeated a 10-term incumbent Democratic Caucus Chair Joe Crowley. Her victory was widely seen as the biggest upset victory in the 2018 midterm election primaries. She went ahead to defeat Republican opponent Anthony Pappas in the November 2018 general election. She was then reelected again in the 2020 election, this time around defeating John Cummings.

Taking office at age 29, she became the youngest woman ever to serve in the United States Congress. She is recognized for her substantial social media presence. Alexandria Ocasio-Cortez attended Boston University, where she majored in international relations and economics. Before running for Congress in 2018, she was an activist and worked as a waitress and bartender.

AOC is among the first few female members of the Democratic Socialists of America to be elected into Congress. She has a progressive platform that include the following:

- Medicare for All

- A federal jobs guarantee

- The Green New Deal and abolishing the United States Immigration and Customs Enforcement (ICE)

The beginning of the controversy

It started when a Twitter account, Tax March, apparently known for advocating for higher taxes, posted a link to the congresswoman’s online store and also complimented a sweatshirt she sells.

The sweatshirt is a plain, black, cotton item with the words “tax the rich.” But is not the style itself that made headlines, instead it was the price tag: a whopping $58. As usual, well deserved criticisms poured in quickly, and one is not meant to back down from a fight. AOC responded immediately to the criticism on her own Twitter account stating that the sweatshirt was produced in United States. She then went on stating that Republicans are just freaking out because “we are not using slave-wage labor for merch to fund grassroots organizing.” And that people can get the sweatshirt for free only if they chose to volunteer for her.

The facts

Like so many Hill staffers, Claudia Pagon Marchena, moonlighted at an eatery to pay her rent until she took a job with AOC. That was the same period she celebrated her last day at her coffee shop job.

That’s because AOC, has called on fellow her lawmakers to pay their staffs a “living wage,” and she is making an example out of her own office. The New York Democrat has been able to introduced an unusual policy that no one on her own staff will make less than $52,000 a year. This is almost unheard of amount for most of the 20-somethings whose long hours make Senate and House offices run.

For instance, Pagon Marchena, 22 year old lady said that this pay bump will mean an end to her grueling, seven-day-a-week work schedule. It was seriously wearing down her and she was finding it difficult to stay in Washington. Where her rent was more than $2,000 monthly.

According to her this was unsustainable, that was why I needed an office that will pay me a fair wage.

This policy, which previously has not been reported, is the latest sign that AOC, as well as other progressive Democrats whose intentions are to buck the well established trend of ostentatious austerity in the offices of the Congress. Some of the government watchdog groups are with the view that deep cuts to office and committee budgets are the main cause of this lack of diversity in Hill offices. As well as high turnover and even congressional brain drain.

Pushing for change

Alexandria Ocasio-Cortez once said that we want to be sure that we do not only offer a living wage to our staff. But that we hire at the appropriate levels for the needed workload that we have, and that we staff our committees in a way that will make sense. She then added by saying that such measures are tied into the party’s whole agenda: “As we try to provide workers greater fairness in the job market and at home, we still have to look at Congress.”

From all indications, Alexandria Ocasio-Cortez aim is to force the conversation, which has started already with the $58 sweatshirt (AOC tax the rich) she launched recently. Remember she made national headlines when she announced that all interns in her office would make $15 per hour plus benefits attached. A rarity for Capitol Hill offices in which interns are unpaid. She went ahead to also highlight the high number of Hill staff members, who still work side jobs to be able to make up for median salaries as low as $35,000 for staff assistants. That’s the lowest paid positions in congressional offices. This statistics is according to a Legistorm analysis.

According to Alexandria Ocasio-Cortez’s communications director Mr Cobin Trent, said the we think that when a person works, they are well able to make enough to sustain themselves. He tied this to his boss’s broader calls for pay equity in the country. AOC tax the rich sweatshirt is a call for the rich to be taxed more, who live among the poor. Alexandria Ocasio-Cortez went ahead to demonstrate it by making the sweatshirt in America and paying the workers the “living wage” of $15 per hour.

Change in action

Pagon Marchena and other employees in AOC’s office are all pointing to their own biographies to prove that this policy has real benefits. Alexandria Ocasio-Cortez’s solution will require huge sacrifices for staffers at the top of the pay scale.

Impact of the living wage on Americans

What is a ‘living wage’?

A living wage is described as a wage that’s enough to meet basic needs and also to provide some discretionary income. This is highlighting the fact that wages should be well enough to support a worker and his or her family.

Let’s breaks down what basic needs means into:

- A standard level of nutrition

- Housing

- Transportation

- Energy

- Healthcare

- Childcare

- Education

- Savings within regulated working hours (for instance without usual overtime hours).

Why is this living wage important?

Minimum wage rates are failing workers at the lowest end of their pay scale and even where established are not met often.

Without this living wage workers might be compelled to:

- Work excessive overtime hours or different jobs

- They become bonded labourers

- Put their own children into work instead of school

- They are denied their basic human rights to food, shelter, nutrition, health, housing and even education. As well as suffer social deprivations like being unable to take part in any events in the community

- They are unable to withstand crises like ill health.

Anf where there is a strong business case, workers on this living wage are likely to be:

- More productive: Because they are better motivated in their work.

- They are less likely to leave: There is reduced attrition, which means lower recruitment and training costs

- They are healthier: Reduced loss of working hours because of sickness.

- The brand reputation will be enhanced also; Their customers will become much more sensitised about the working conditions of those producing the products they purchase.

- It might reduce government spending. Workers on the low wages have to depend on benefit payments for them to survive. But when these workers are on a living wage, government can be able to cut benefit spending.

How does this living wage differ from minimum wage?

A minimum wage is a wage that’s on a national floor level strictly set by the government.

Most countries have be able to set a legal national minimum wage for their workers. It is basically agreed via negotiations between government, industry and sometimes even trade unions. However, this practice might not always work as intended, because sometimes there is no real representation of workers.

A living wage is a wage that workers need to provide for their families with decent standards of living.

Why is this living wage rising on the global agenda?

With the rising phenomenon of the working poor since the 2008 recession. This simply means people who are working, but are not able to make ends meet because their wages are rather too low. We should understand that the gap between national minimum wages and cost of living is increasing rapidly every day. The growing awareness and concern of customers about the working conditions of these workers are also on the increase.

What are the challenges to achieving these living wages?

These wage levels come about via a complex economic process of labour supply and demand. As well as through negotiations, established policy norms, the power relations between these workers and employers etc. Artificially setting these wages can be impracticable or can even lead to unintended consequences. If entire budgets are not increased, the increasing wages for some workers may lead to others being laid off or not recruited at all. Trust me, this will certainly lead to an increase in unemployment. This might even cause lower skilled workers, to be priced out of the job market. Why? Because the value they bring is not in any way seen to be equivalent to the new higher level of wages. Believe me, companies might be unwilling to increase the prices they pay to their suppliers for products.

What is the way forward for brands and retailers?

It is very important for companies to look beyond these definitions and calculation strategies in order to think more about inclusive mechanisms. That will ensure that this living wage will be a product of a process of negotiation which is able to respond to externalities over time. And how this will also be accommodated in the value chain. As part of this process it is crucial to consider the specific rate of pay in a specific location and industry. So, for me companies should do the following:

- They should build long term, mutually trusting relationships with their suppliers and work together to understand the drivers of prevailing wage levels.

- Consult with their workers/managers in order to calculate living wage levels.

- They should ensure cost of living wages are accommodated throughout the value chain.

- Improve their workers’ collective bargaining power and also ensure their right to freedom of association is highly respected.

- Improve productivity and efficiency in order to enable the value chain to accommodate wage growth.

Taxing the rich is fine

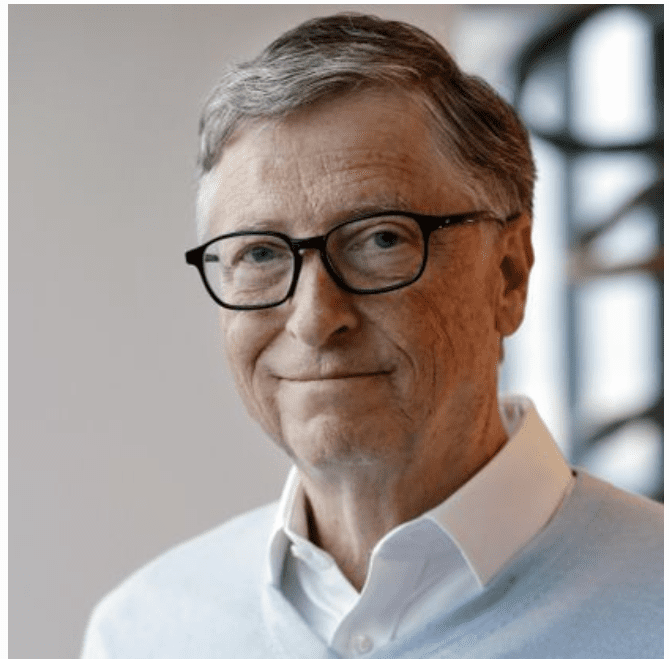

One of the richest people in the world, Bill Gates has come out to say he is supporting more progressive taxes on the rich. But proposals targeting the high income brackets, like the plan from Rep. Alexandria Ocasio-Cortez are just missing the point.

AOC has pushed that raising the top marginal tax rate to 70% on income more than $10 million. Currently, the top marginal rate is 37%. In an interview, Bill Gates said such an approach is just a misfocus. He then continued by saying that If you are focusing on that you’re just missing the picture, he said this without mentioning Alexandria Ocasio-Cortez by name.

Read more on how the rich safeguard their wealth.

In terms of collection of revenue, there is no need to just focus on the ordinary income rate. Because people who are very wealthy do have a rounding error of ordinary income, Bill Gates, one of the richest people in the world, told The Verge in an interview. They do have income that is just the same value of their stock, which when they don’t sell it, it won’t show up as income at all. And when it shows up, it will show over in the capital gains side. The question then, what could Democrats’ plans could mean for inequality, spending and growth?

Bill Gates said, lawmakers should rather focus more on things like:

- The estate tax

- Taxes on capital

- Social Security

Other people views

This his view might be more aligned closely with Sen. Elizabeth Warren’s proposed tax policy that focuses more on taxing net worth on households that is worth more than $50 million. Bill Gates continued by saying, “now you do have some politicians who are so extreme with their thought that I would say, ‘No, that’s even more beyond. That’s an apparent reference to Alexandria Ocasio-Cortez. You start to create tax dodging and disincentives, together with an incentive to have the income clearly show up in other countries as well as on products. But we may be much more progressive without really threatening generational wealth. That’s what you have decided to pass on to the next generation.

Bill Gates, who held the title of the richest man in the world on and off for many years. Before Amazon CEO Jeff Bezos just unseated him from that position, also ripped the increasingly modern monetary theory.

The theory, also known as MMT, also dismisses concerns about sovereign debt since countries that can print their own currency can not in any way run out of money.

And finally

Some work has already been undertaken to establish a living wage figure in particular industries and also locations. However it’s probably more useful and sustainable for us as a country to ensure robust economy with the necessary mechanisms and frameworks properly put in place. This will allow for the informed negotiations to take place on a regular basis between employers and their workers. In many countries including United States here most brands source for their products wages are set to fall far below any interpretation of a living wage. So, whether or not an exact number has been calculated, it is worth seeking ways to ensure that these workers wages are improved to a point that they are able to provide for their families. So, AOC tax the rich movement is on point and need to be looked into by the government.